Key Events: The best is yet to come (?)

Nvidia, a primary driver of recent returns, soundly beat earnings estimates and raised expectations; the company believes best is yet to come.

The other driver of markets, the Fed, has been less consistent. Meeting minutes clarified that inflation has not declined enough, so rate cuts may be on hold.

Market Review: Earnings season provides mixed messages

The stellar Nvidia earnings report drove gains in the tech sector. Several concerns materialized this week, however.

- The retail sector showed poor sales data[1], and several retailers missed earnings estimates.

- Credit delinquencies are increasing.[2]

- News reports noted losses realized by A triple-A rated real estate-backed bond.[3]

Both the consumer and real estate sectors appear to be weakening. Inflation worries added to the mix, causing both stocks and bonds to end the week lower.

Outlook: Focused on earnings growth and the Fed

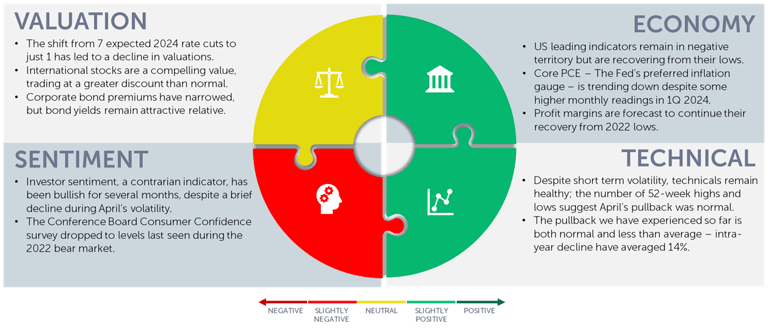

The whole market, not just the tech sector, needs to report solid earnings in 2024 to support solid stock returns. Analysts believe earnings will broaden, and stock returns should be less reliant upon tech.

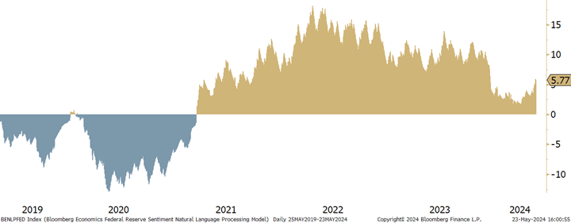

We are also watching the Fed–what they say and what they do. The chart below illustrates the sentiment of Fed speakers over time. The Fed became more concerned about inflation in April and May. With the S&am;P 500 up 11% YTD, it may be wise to temper market enthusiasm just a bit.

We are positioned for these concerns. Our portfolios are diversified, and we have shifted our fixed income portfolios to a more cautious stance. Likewise, we are focused on risk management in every asset class.

We are not worried about poor earnings or inflation, but we are prepared for them.

The Federal Reserve has become more hawkish in recent speeches [4]

Navigator Outlook: May 2024

Download PDF Version

This material is intended to be educational in nature,[5] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg US Retail Sales Stall After Downward Revisions in Prior Months - Bloomberg

[2] Source: New York Fed Quarterly report on household debt and credit

[3] Source: Yahoo Finance Losses Pile Up in Top-Rated Bonds Backed by Commercial Real Estate Debt (yahoo.com)

[4] Source: Bloomberg Economics. This chart is the result of a natural language processing model, generated by artificial intelligence, which measures how hawkish (biased towards higher rates) or dovish (biased towards lower rates) Fed officials are in the speeches they give. After becoming more dovish throughout the year, we have seen a spike in hawkish sentiment during April and May.

[5] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00804