OUR APPROACH

You invest because you are called to...

provide for your family

educate your children

give generously

prepare for the future

respond to the unexpected

prioritize what matters most

Your values inspire why you invest.

They can also inspire how you invest.

Business impacts the world in powerful ways.

Investors should consider who a business impacts and how they are impacted.

We assess how a company interacts with every single person and every square inch.

We seek to elevate companies that demonstrably and consistently promote flourishing for these stakeholders.

We believe that when a business does this well, it can create value greater than the sum of its parts.

Our Approach to Values-Based Investing

Eliminate

companies whose productsor practices cause harm

Evaluate

companies to identify those thatmeet our investment objectives

Elevate

companies that makethe world a better place

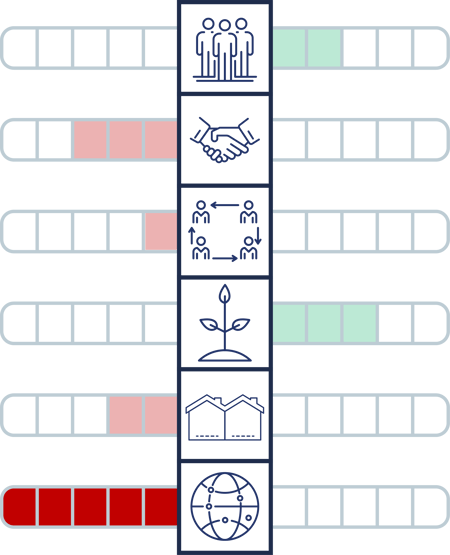

Eliminate companies whose products or practices cause harm

We seek to avoid profiting from companies whose principal business activities and practices include:

| Abortion | |

| Pornography | |

| Adult entertainment | |

| Tobacco | |

| Gambling | |

| Human rights violations | |

| Predatory lending | |

| Alcohol | |

| Cannabis | |

| Severe ethics controversies |

Evaluate companies to identify those that meet our investment objectives

We identify companies that have the potential to be both great businesses and great investments.

| Portfolio management team with decades of investment experience in global equity markets, private equity, and multi-asset portfolio strategy | |

| Partnerships with industry leading research, data, and investment firms | |

| Proprietary equity research that integrates corporate life cycle, valuation, and fundamental analyses | |

| Comprehensive macro-environment research and indicators for technical, economic, and sentiment factors | |

| Institutional private market capabilities including proprietary deal flow pipeline and impact scoring methodology | |

| Values-based investment solutions for every risk tolerance, account size, and investor type |

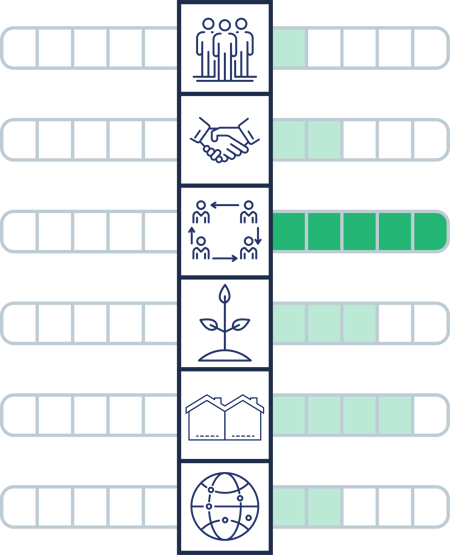

Elevate companies that make the world a better place

We believe that businesses do well by doing good. Therefore, we seek to identify companies that elevate:

| Flourishing families | |

| Sanctity of life | |

| Quality healthcare | |

| Education access | |

| Dignifying vocations | |

| Economic advancement | |

| Environmental stewardship | |

| Affordable housing | |

| Viewpoint diversity | |

| Equal opportunity | |

| Thriving communities | |

| Fair labor |

See our values-based investing approach in action:

Turnkey Models

Learn More

Individual Strategies

Learn More

Target Date Funds

Learn More

Exchange Traded Funds

Learn More

Reference to OneAscent’s values-based investing approach is provided for illustrative purposes only and indicates a general framework of guiding principles that inform OneAscent’s overall research process.

OneAscent’s judgment about the quality, alignment, or impact of a particular company may prove to be incorrect. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses.