Key Events: Debt, Downgrades and fewer Discounts

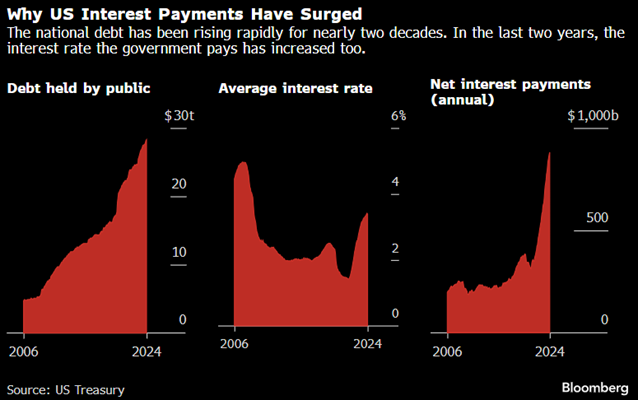

Moody’s downgraded US Government debt over concerns about increased debt and our long-term fiscal sustainability (see chart below).

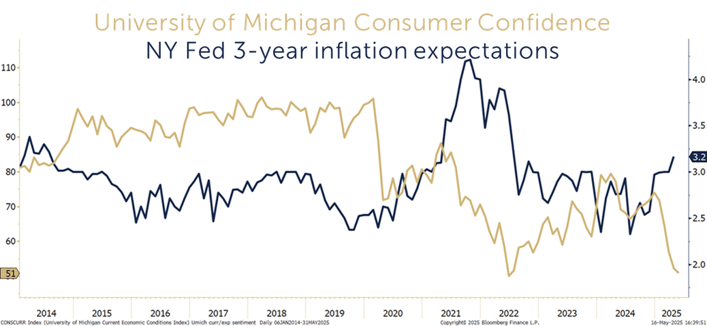

Consumer confidence continued its decline, approaching historic lows. Despite a softening in April’s data, inflation concerns remain elevated. Walmart added to the unease; warning of potential price increases due to new tariffs.

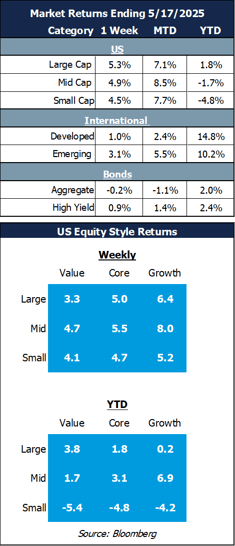

Market Review: The ‘tariff rebound’ continues

Markets rallied again this week as tariff-related fears eased. The S&P 500 led the way with a 5% gain, outperforming both international and small-cap stocks. Hedge fund short-covering contributed to the momentum. Meanwhile, investment-grade bonds remained flat, caught between inflationary pressures and signs of slowing economic growth.

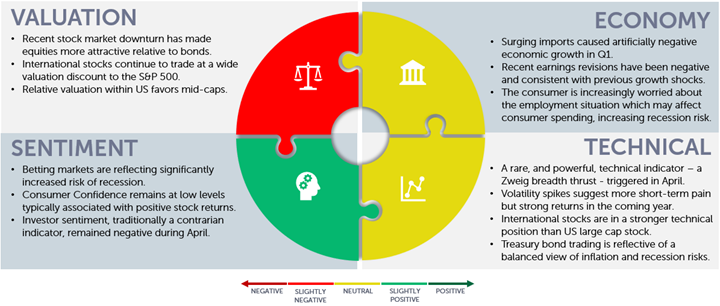

Outlook: Navigating shifting sentiment

Equities have staged a strong recovery, with the S&P 500 climbing nearly 20% from recent lows as trade tensions subsided. In our April 28 Weekly Investment Update, we highlighted the drop in market volatility and the potential for short-term gains. Moody’s downgrade underscores the long-term risks posed by rising debt and persistent deficits—issues we explored in depth last fall in What to do about the coming debt crisis.

While short-term market movements can be unsettling, our Navigator Framework helps investors stay focused on long-term goals. We began the year with diversified portfolios, anticipating the volatility we’ve seen. Our guidance remains the same: stay the course, remain invested, and follow your financial plan.

Confidence falls as inflation expectations rise

USA’s Fiscal situation precipitated the ratings cut

Navigator Outlook: May 2025

Download PDF Version

This material is intended to be educational in nature,[1] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01253