Key Events: Tone shift sparks a rally

Global markets enjoyed a healthy relief rally as President Trump acquiesced on two fronts last week: he has no intention of firing Fed Chair Powell, and he intends to be “very nice” to China on trade.[1]

The Federal Reserve released the Beige Book on Wednesday. A word count highlighted the dominant theme: “uncertainty” created by “tariffs”.[2]

Market Review: Stocks stage a recovery

Global equities rebounded vigorously last week on hopes that the peak of trade war fears is now in the rearview. Embattled US growth stocks propelled the S&P 500 to a 4.6% surge, while international stocks continued their advance, up 2.5%.

Bonds clawed back more of their tariff-induced selloff as they rose nearer to break even for April, while Gold slid modestly for the week, but only after hitting new highs again last Monday.[3]

Outlook: Thinning fog with lurking uncertainty

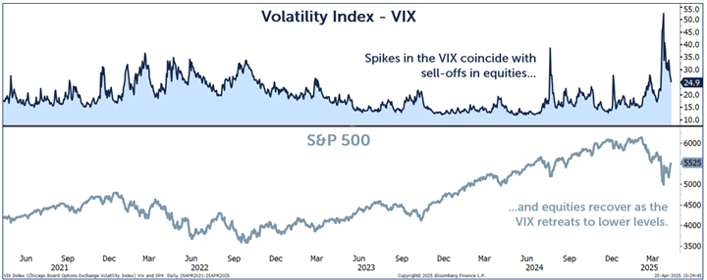

Cooler heads prevailed as Treasury Secretary Scott Bessent indicated that the current trade war with China was not sustainable and that he expected a “de-escalation” in the US-China tariff fight in the “very near future”.[4]Secretary Bessent has proven to be a calming voice for markets through this period of heightened volatility. His comments on trade, coupled with reassurance that Federal Reserve Chair Powell would retain his seat, quelled market fears and ultimately shaved ten points off the VIX Index in four days.

Excessive volatility leads to sharp equity moves in both directions. Sharp recoveries during sharp declines in volatility are welcome, but we always retain a long-term perspective. Uncertainty regarding global trade and capital investment remains high and unresolved. The fog may be thinning, but the outlook is far from clear.

The VIX has declined from a multi-year peak, but it remains well above preferred levels. After several spikes in 2022, the VIX pulled back but never fully retreated and the market managed to find lower levels until it became clearer that the inflation outlook was under control. We would not expect a full reversal of the VIX until there is a well-defined picture of the global trade outlook and a better understanding of the corresponding impact on global growth.

Last week’s reduction in uncertainty enabled a decline in market volatility that almost always coincides with improved equity performance.

Navigator Outlook: April 2025

Download PDF Version

This material is intended to be educational in nature,[5] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg article by John Authers, “The ‘Trump Put’ Makes an Entrance, Up to a Point”.

[2] Source: Bloomberg article by John Authers, “The ‘Trump Put’ Makes an Entrance, Up to a Point”.

[3] Source: Bloomberg data.

[4] Source: CNBC Television report that aired on 4/23/2025.

[5] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01225