Key Events: Inflation and AI accelerate

Two hot inflation reports affirmed the Fed’s cautious stance on rate cuts in 2024.

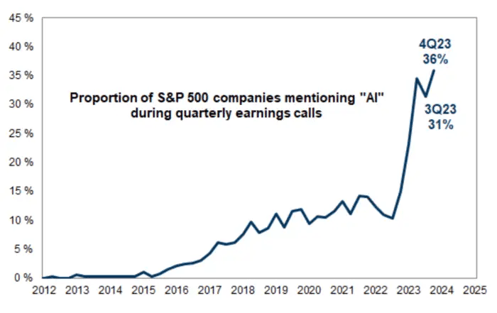

AI continues to dominate; More than a third of the S&P 500 companies mentioned AI in 4Q earnings calls. (See chart below)

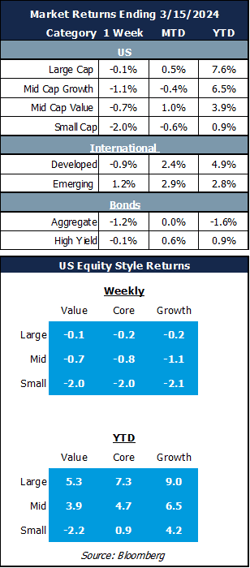

Market Review: About those rate cuts

Markets responded negatively to higher than expected inflation by lowering expectations of rate cuts. Small caps led stocks down, losing 2%. Bonds also reacted negatively.

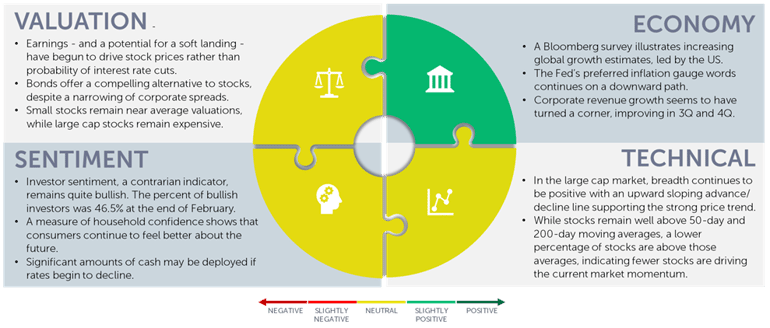

Outlook: Probability of a soft-landing – Part II

We have outlined three possible scenarios Monthly Update - March 2024 (oneascent.com);last week we discussed risk to a soft landing.

The market currently believes a soft landing scenario is most likely, but the risks of either rising inflation - or recession - have likely increased:

- The Atlanta Fed’s “sticky price” inflation measure remains at 4.4% year over year, well above target[1]

- Leading economic indicators have been negative for 22 months, similar to the 2008 Financial Crisis[2]

Our portfolios contain allocations intended to offer downside protection in the event of inflation or an economic downturn. Our philosophical bent towards diversification may also provide a cushion, allowing us to respond to market opportunities. We encourage you to use this link to sign up for our quarterly market webinar to hear more Quarterly Market Update Registration.

AI Dominates Earnings Calls: Corporate Chatter Goes Digital! [3]

Navigator Outlook: March 2024

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Federal Reserve bank of Atlanta Sticky prices are things such as medical care, rent and medical care Are Some Prices in the CPI More Forward Looking than Others? We Think So. (atlantafed.org) The Fed’s inflation target is 2% - 2.5%.

[2] Source: Conference Board. Leading indicators were negative for 24 moths during the Global Financial Crisis and 22 months during the mid-1970s stagflation. US Leading Indicators (conference-board.org)

[3] Source: business Insider, Goldman Sachs S&P 500 Earnings Mentions of AI Hits Record Level in Latest Quarter (businessinsider.com)Chart title source: ChatGPT

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00685