Key Events: State of the campaign, and economy

President Biden kicked off his 2024 campaign against Donald Trump, the presumptive GOP candidate, during his State of the Union speech.

Fed Governor Powell suggested rate cuts would begin this year, and employment data was positive.[1]

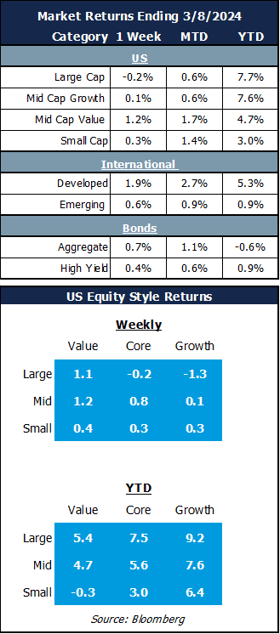

Market Review: cheering for a soft landing

Markets continued February’s broad participation as most markets outperformed the S&P 500.

Bonds gained as the market digested the higher likelihood of rate cuts and a soft landing.

Outlook: The probability of a soft-landing

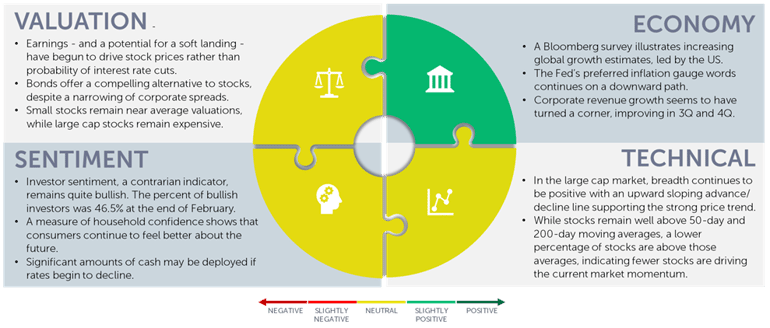

What are the economic and market pros and cons? GDP estimates have increased, employment is strong, and earnings are growing. However, credit delinquencies are rising, and employment gains have been driven by from part-time work.

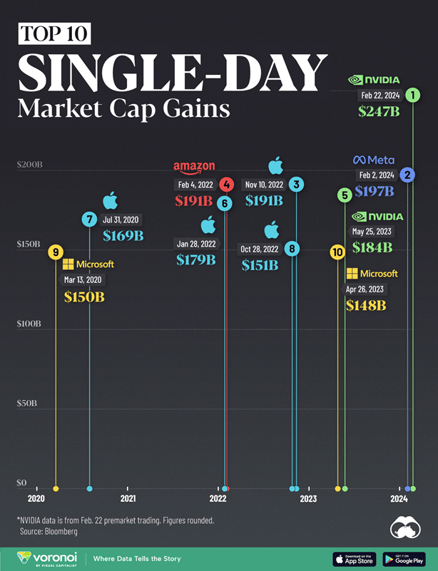

Markets have delivered some huge one-day gains over the past year (see the below chart) and remains in a strong up-trend with broad participation. Market leaders, however, are stumbling a bit – the Magnificent 7 have become the Fab 4, as Apple (-10%), Alphabet (-3%) and Tesla (-29%) have all fallen this year.

Risk and opportunity are two sides of the same coin. The market expects a soft landing, which will likely cause portfolios to perform well. However, as we note here Monthly Update - March 2024 (oneascent.com) our portfolios remain diversified. We attempt to position them to both benefit from rising market and protect against the increasing potential of a market downturn. A strong start to 2024 provides a great opportunity to take stock of your portfolio risk.

Strong momentum in the largest names has driven stock returns [2]

Navigator Outlook: February 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bureau of Labor Statistics. The unemployment rate rose slightly to 3.9% and February payrolls grew more than expected.

[2] Source: Visual Capitalist Ranked: Top 10 Single-Day Market Cap Gains (visualcapitalist.com)

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00680