Understanding Inflation

December 17, 2021 •Nathan Willis

Earlier in 2021, we published an article on whether or not you should be worried about inflation. We argued then, and we maintain today, that inflation is caused by supply, demand, and stimulus, all of which have been and still are out of balance due to the pandemic.

U.S. inflation hit a 39-year high in November, prompting The Federal Reserve Chairman to stop using the word ‘transitory’ to describe the current inflation. We acknowledge that increased inflation may persist into the next year. It is important to understand how long inflation might last and what we should do about it.

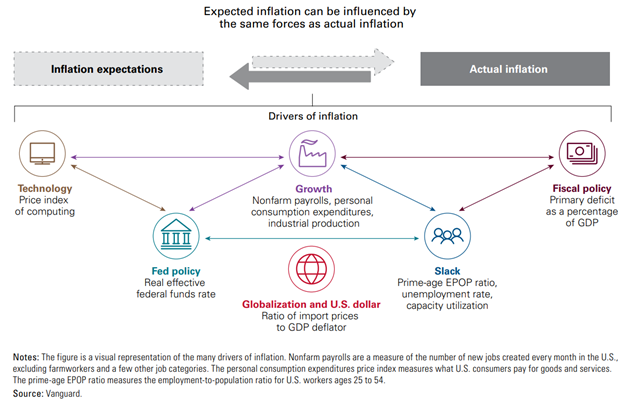

Like most things we experience in life, inflation is a mixture of expectation and reality. Vanguard’s ‘inflation machine’ illustrates the interrelation of inflation drivers, maintaining that internal expectations of consumers influence external drivers of inflation.

The illustration above shows us that no one factor causes inflation to increase or decrease. Technology advances, employment numbers, consumer spending, rate adjustments from the Fed, international trade, tax policy, external shocks (like COVID), and a multitude of other factors weave a web that determines how much a dozen eggs or a gallon of gas cost.

Though the situation is complex, looking at one specific factor—employment—may provide valuable insights.

Employment and Demand

A Netflix political drama a few years back featured a president who promised a zero percent unemployment rate to the American people. While this sounds appealing, it is not practical. Workers are always interviewing for better jobs, and technology is making our industries more efficient. A little bit of unemployment is natural.

Employment matters for inflation because it directly affects demand. Employed people demand more goods and services, and increased demand can cause prices to rise.

Economists surmise there is a natural rate of unemployment for the US at any given time—a rate low enough to be healthy, but not so low that it sparks inflationary pressures.

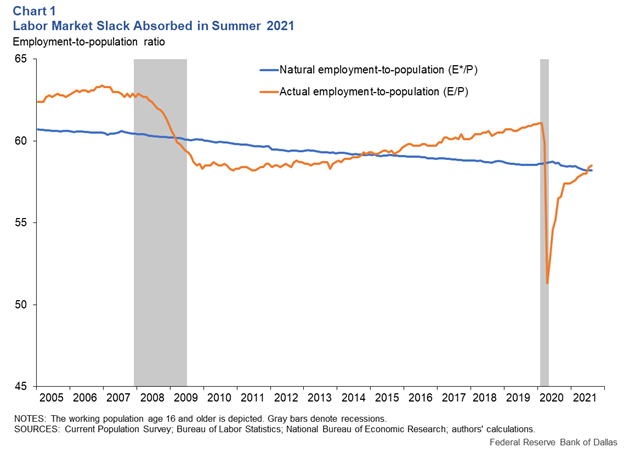

Look at the chart below. Prior to the pandemic, way more people were working than was natural. This is what economists call a tight labor market. Then COVID hit, providing a reset of sorts to business and commerce as we know it. Companies laid off employees, some workers quit, and the transition back to work has been slow. Why? Because the reset of COVID gave people a chance to consider doing something else. Someone could take a remote job across the country—or someone could choose a gig job or assume primary homemaking responsibilities (neither of which are counted as ‘employment’).

The labor market doesn’t feel tight right now, though, or even at near equilibrium (which is where we are). It feels like there’s a tremendous amount of slack, less people working than the economy needs. After all, there are 2.3 times more job openings today (10 million) than people who’ve left the workforce since the pandemic began (4.3 million).

So if the labor market and employment are ‘normal,’ why are prices still so high?

Daycare workers provide a great example. We know prices are climbing. This, combined with COVID concerns, leads daycare workers to demand higher wages. Higher daycare wages make daycare more expensive. More expensive daycare incentivizes parents to quit their jobs and assume primary childcare responsibilities. Parents dropping out of the labor force leads to a labor shortage, which raises prices, which leads to daycare workers demanding higher pay, and the cycle continues.

Employment is one strand in the web of inflation factors. Other factors that affect inflation are supply chain issues (including a microchip shortage) and historically low interest rates. While demographics contribute to inflation today, we believe they will combat inflation in the years ahead.

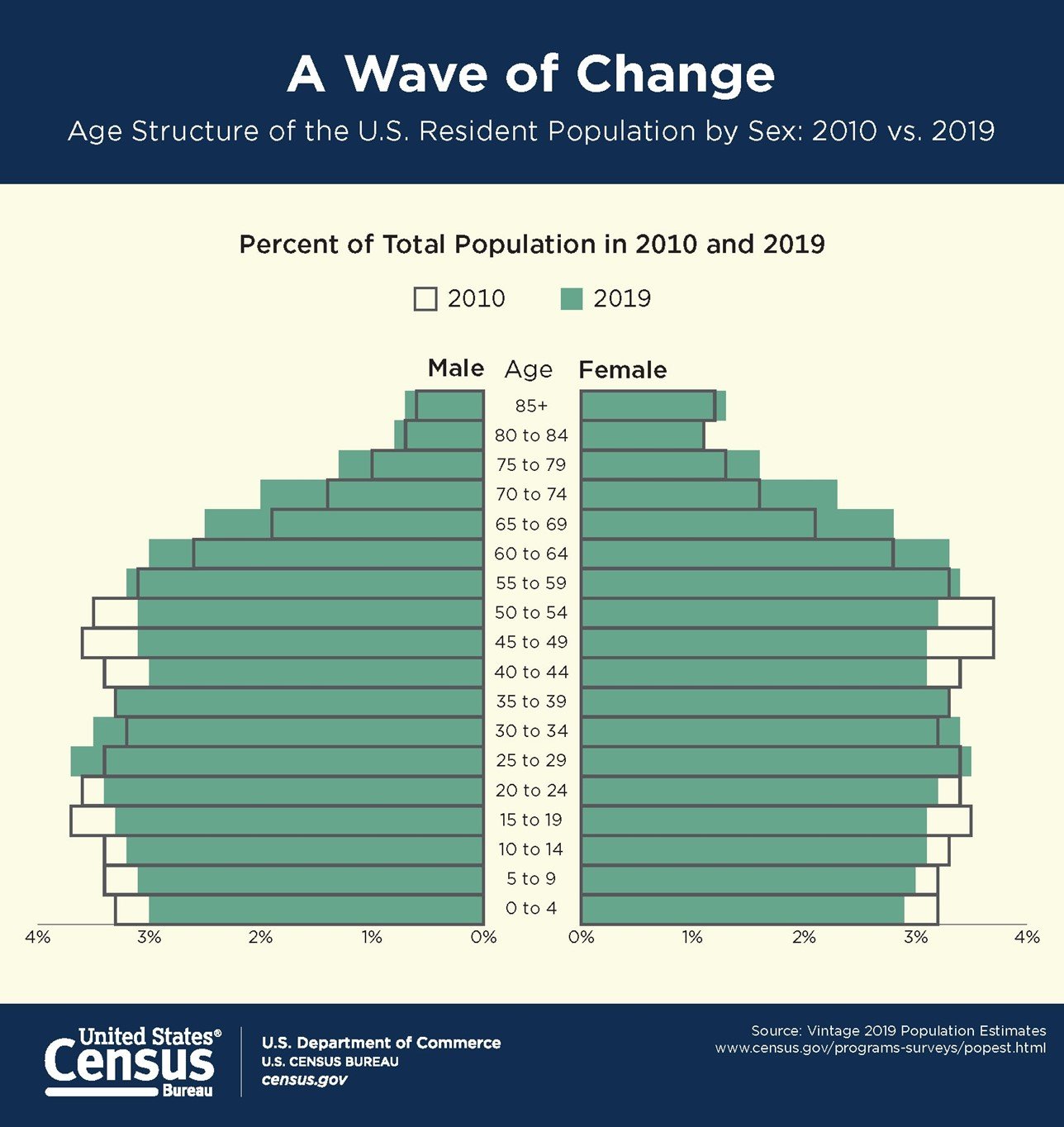

The U.S. population is aging. In fact, the population is growing at its slowest rate since the Depression. As workers age, they retire, and they are living longer lives in retirement. However, when someone retires, they demand less goods and services, as they are less likely to splurge living off retirement savings.

Remember, demand is part of the inflation recipe. The infamous, rampant inflation of the 1970s was caused in part by an increase in demand as labor force participation skyrocketed. But over the next decade, experts predict labor force participation will decline as our aging population retires, causing a decline in overall demand. Accordingly, the decrease in demand will also decrease the rate of inflation.

-OneAscent-Understanding-Inflation-Nathan-Willis.png)

Employment and Supply

If you’ve tried to buy a car or a PlayStation this year, you’ve likely Googled, “What is wrong with the supply chain?”

In our last article on inflation, we argued that the Evergrande ship blocking the Suez Canal was a factor in the global supply chain disruptions. Though that situation has resolved, big boats are still an issue. There have been 3-4 times more cargo ships in the LA and Long Beach ports this winter than in past years. This amounts to approximately 12 million metric tons of goods stranded off Southern California’s coast alone. In short, our largest center for trade with Asia is completely bottlenecked. Why?

While it’s easy to blame job vacancies, not all supply issues are caused by the labor market’s recent turbulence. For instance, The Wall Street Journal reports on a hot tub model that requires 1,850 parts, sourced from seven countries and 14 states. The parts travel nearly 900,000 miles cumulatively to the Bullfrog Spas production plant in Herriman, Utah. External factors such as the Texas winter storm last February, trucking company closures, fluctuating demand for and reduced supply of semiconductors, and yes, the Evergrande kerfuffle decimated the company’s operations management system. Bullfrog hot tubs now take up to six months from order to delivery.

Many of these factors are out of companies’ control in the short-run. However, big businesses have begun investing heavily in technology to mitigate future threats. Even if declines don’t come quick enough for inflation to be considered “transitory,” technological and supply chain improvements will eventually pull inflation down in ways that did not happen during the inflationary 1970s.

Eighty-five percent of CEOs surveyed by Deloitte said that COVID accelerated their company’s digital transformation. As investments in tech grow more aggressive, certain jobs may face displacement. For instance, citing the pandemic-induced labor shortage, Tyson Foods plans to spend $1.3 billion over the next three years to automate much of its production lines. Though Tyson has increased benefits to incentivize worker retention, robots do not have family obligations or require sick leave.

Though some pre-pandemic studies project significant job shredding in the US labor market due to automation, the good news is that technology is a deflationary pressure. Tech improvements temper the labor market, decreasing demand, while simultaneously increasing the economy’s capacity to produce goods, increasing supply. Decreased demand and increased supply drive down inflation. In short, businesses’ response to the COVID supply chain crisis may keep inflation at bay in the years ahead.

Conclusion

I recently read a quote that summarizes the inflation conversation well. “Complicated matters require intelligence. Complex matters require wisdom.”

Inflation is both complicated and complex. The web of factors at play makes it difficult to comprehend. But more importantly, are you investing wisely in light of inflation?

The OneAscent team continues to monitor our strategies and ensure you are capitalizing on the opportunities inflation presents in the market. If you’d like to discuss your plan, we’d love to hear from you!

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.