Monthly Update - January 2025

January 6, 2025 •Nathan Willis

December Review – Bitcoin and stock speculation

In 2020, Microstrategy start buying bitcoin.[1]From 2019 to the end of 2024, when the stock was added to the NASDAQ 100, its market cap increased by almost $70 Billon.[2]

Yes, this company - with declining revenues – has been added to the NASDAQ and the co-founder, Michael Saylor, has become something of a Bitcoin evangelist.[3]

Because they issued stock and convertible bonds, using the proceeds to buy Bitcoin.

If the software business is now worth $2 Billion,[4]that still leaves $27 Billon of market cap that is essentially speculation on the price of Bitcoin.

Every one who owns the NASDAQ owns a portion of this company.

This story is relevant now, because Microstrategy was down 25% during December - the month that it was added to the NASDAQ. As the market gave up some of its gains for the year, MicroStrategy fared far worse, after achieving massive 2024 gains.

Microstrategy is emblematic of the the optimism that permeates US stocks and the volatility that characterized December. Another way to look at it is this chart from our Capital Market Assumption White Paper. Investor allocations to equities are as high as they have ever been, leaving little room for error.

Before we talk about how this may affect our outlook and portfolio positioning, lets review the numbers for December.

December Market Review

Bonds sold off in December as inflation proved sticky, causing the Fed to tamp down expectations for 2025 rate cuts.

- Investment grade bonds lost as bond yields rose sharply; yields are now almost 1% higher than when the Fed started cutting rates in September.

- Large cap stocks dropped by over 2%, ending the year with solid 25% gains.

- Smaller stocks sold off much more than large due to a resurgence of inflationary fears.

- International stocks retreated as non-US economic data surprised to the downside.

- High Yield bonds turned in modest losses on declining risk appetite.

Stock sector movements were consistent with increased inflationary pressures

- Interest rate sensitive stocks such materials, energy and real estate led the decline as inflationary pressures led to higher interest rates.

- Communications, Consumer Discretionary, and Technology stocks performed well as the “Magnificent 7” rose 6% on increased earnings estimates. December returned to the 2024 trend of outstanding Artificial Intelligence-driven returns.

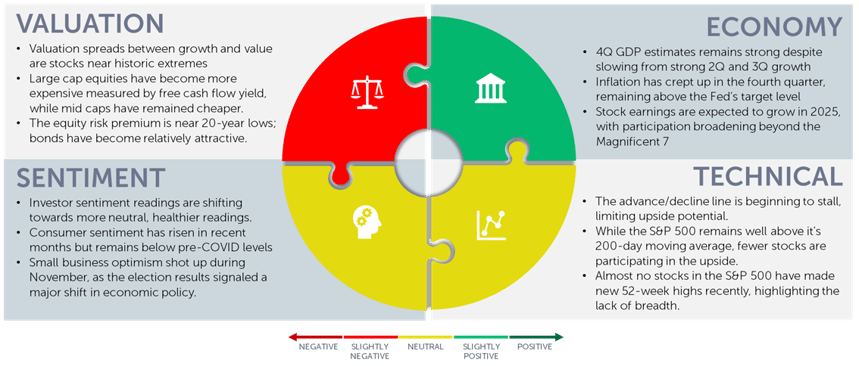

Our Navigator framework informs our outlook.

January 2025 Navigator Outlook

Economy: The economy remains strong despite 4Q growth estimates showing slight declines from 2Q and 3Q growth. Inflation’s decline, though, has hit a speed bump due to strong consumer spending. Corporate earnings estimates have declined slightly, but expectations remail for strong overall growth, supported by a the broad market beyond the “Magnificent 7” which drove growth in 2023 and 2024.

Technicals: The broad US equity market remains in a positive trend, but several indicators are flashing caution: The advance/decline line is beginning to stall, limiting upside potential. Fewer stocks are above their 200-day moving average, suggesting the positive trend may be weakening. The number of 52-week highs dropped sharply in December, highlighting the lack of breadth in market returns.

Sentiment: Investor sentiment readings are moving towards more neutral, healthier readings. Consumer sentiment has risen in recent months, but remains stubbornly below pre-COVID levels. Small businesses are a bright spot, as November’s election results drove a sharp rise in optimism in the National Federation of Independent Business survey.

Valuation: Valuation spreads between growth and value stocks, particularly in the large cap space, have reached historic extremes of as growth stocks continue to soar. Meanwhile, the free cash flow yield of mid cap stocks has remained stable, suggesting good value remains outside the mega caps. Bonds continue to remain attractive relative to stocks, it has been more than 20 years since the yield of the broad bond market has been as high relative to the earnings yield of large stocks.

Outlook and Recommendations: Expectations for the new year

As we begin a new year, we are bombarded with forecasts; we must understand market expectations for the sake of comparing them to fundamentals. First, let us compare the outlook for interest rates. Inflation has stalled, and expectations have shifted from 2024: at the beginning of last year the market expected a 2% decline in rates. However, growth was stronger than expected and disinflation stalled, so we finished the year with a 1% decline.

Expectations for 2025 are more realistic – the market only expects 2 rate cuts this year, as inflation remains stickier than expected and growth expectations remain strong.  While there are downside risks to growth, we remain focused on the potential for higher rates in the coming months.

While there are downside risks to growth, we remain focused on the potential for higher rates in the coming months.

Stock forecasts present a more entertaining exercise in observing Wall Street expectations. In one of our recent Weekly Updates, we offered you the Christmas gift of ignoring their forecasts by showing how far off the mark they have been. This chart illustrates the futility of forecasting:

At the beginning of 2024, Wall Street strategists forecasted a slight gain in the S&P 500; the market finished with a 25% gain.[5]

It is notable that now, after missing a 25% gain, that strategists have become optimistic for 2025. The chart below shows a selection of Wall Street forecasts; most strategists expect a 10% - 20% gain over the S&P 500’s 2024 closing value of 5881.

The market expects earnings to grow by roughly 10% in 2025[6], so most forecasts are expecting the market’s valuation to increase. We believe that, given the potential for inflation to remain, keeping interest rates steady – if not higher – we may not want to count on the market’s P/E ratio to expand as it has in recent years.

It does make sense, however, to expect the earnings situation to improve. 2023 and 2024 earnings were dominated by the magnificent 7 companies’ AI driven gains; gains that where entirely unexpected, and which came at the perfect time – right after the banking crisis triggered by Silicon Valley Bank. AI driven earnings gains supported the market, giving the Fed time to shore up the financial system.

Now that the market has moved beyond this banking crisis, it makes sense to expect that earnings and stock performance will broaden beyond the technology sector.

The other significant factor is a bit unknown – exactly what policies will President Trump be successful in implementing, and how will they affect growth. The consensus is that his “America first”, protectionist policy bent will be positive for US growth, but potentially inflationary.

Valuations remain high for US large cap stocks, but more attractive values can be found elsewhere in the stock and bond markets. Given solid fundamentals but only modestly attractive valuations, let’s lay out our portfolio construction for 2025.

Portfolio Positioning

Our positioning continues to reflect our long-term focus paired with active risk management:

- While we remain globally diversified, we are shifting equity portfolios to be more US-centric, focused on quality companies with solid cash flows.

- We retain significant allocations to mid and small caps in the US with lower allocations to large cap stocks. We added to our position in mid-cap value in our tactical sleeve. We have lowered our exposure to growth stocks that may suffer from higher rates and their impact on valuations.

- Our bond portfolios are positioned for steady, and potentially higher, interest rates, with exposure to floating rate high yield debt in our tactical sleeve and higher allocations to corporate and mortgage bonds, with fewer treasuries.

We just experienced two years of 25% returns. This has happened four times since the 1920s, with a wide range of outcomes for the following year – from down 35% in 1937 to up 21% in 1999[7]There are a wide range of potential outcomes in 2025; sound portfolio construction, rather than forecasting, is the road to success.

As always, we remind investors to focus on the long-term plan, exposing your portfolio to assets with a solid risk/reward profile while managing short-term risk with prudent diversification.

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: The primary business was suffering difficulties and, in 2020, was forced to significantly restate

[2] Source: Bloomberg, OneAscent Investment solutions. Illustration assumes the December 31, 2024, market value of Bitcoin holdings and $2Billion market value for the software business, which was valued at approximately $1.5 Billion in 2019; revenues have declined since 2019. The remaining value is considered speculation on the value of Bitcoin based upon the prices at which issued convertible bonds may be converted, which is well in excess of current share price.

[3] Source: Michael Saylor notably supported a shareholder resolution for Microsoft to purchase Bitcoin – it was rejected. Microsoft shareholders reject a proposal for the tech giant to possibly invest in bitcoin

[4] Source: It is unlikely the core software business, with declining revenues, is worth $2 Billion; $2 Billion value assumed to make the point that there is $25 Billion of value unaccounted for, which we believe is speculative, based on assumed growth in value of Mictrostrategy and/or Bitcoin.

[5] Source: Bloomberg

[6] Source: Business Insider. Here's a Complete Rundown of Wall Street's 2025 Stock Market Outlooks - Markets Insider

[7] Source: Bloomberg

OAI01053