Key Events: The Fed's "Hawkish rate cut" paradox

The Fed provide what Wall Street described as a “hawkish” rate cut – guiding to fewer rate cuts and higher inflation than previously expected for 2025.

A survey of economists agreed with Fed expectations: 2025 inflation forecasts rose from 2.3% to 2.5%. Growth expectations rose as well, as 3Q GDP was revised from 2.8% to 3.1%.[1]

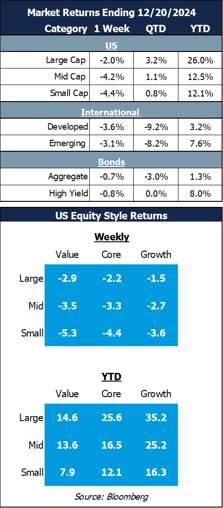

Market Review: A fragile market takes a beating

Bond markets sold off on resurgent inflation, while stock multiples declined on lowered expectations for rate cuts in the face of high valuations.

Global stocks suffered broadly, led by smaller US stocks as the market adjusted to fewer rate cuts.

Outlook: A Christmas gift just for you

Hours reading Wall Street investment outlooks have given us a key insight – their forecasts aren’t worth much! The chart below illustrates their inaccuracy.

Our gift to you is freedom from paying attention to the noise; our prayer is this allows you to focus on the blessings of the season:

“Glory to God in the highest heaven, and on earth peace to those on whom his favor rests.”[2]

While praying for peace we urge investors to maintain their long term discipline, helped by data in our 2025 Capital Market Assumptions white paper, and to position portfolios for important risks, such as the risks of blowout government spending we highlight in our Fiscal Deficit White Paper.

We wish you a very Merry Christmas!

Don't waste your time following forecasts

Navigator Outlook: December 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg News Economic Survey

[2] Source: Luke 2:14 English Standard Version

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01065