Target Date Funds

Your values inspire the way you live today.

Shouldn’t they inspire the way you invest for retirement?

The OneAscent strategies combine a disciplined investment process, a commitment to values-based investing, and the simplicity of a target date approach.

|

Quick Links

|

|---|

Disciplined Investment Process

OneAscent adheres to a well-defined investment process comprised of four primary components: Strategic Allocation, Manager Selection, Tactical Allocation, and Portfolio Monitoring. This process considers fundamental investment research, potential growth opportunities, and risk management. A manager of managers approach allows us to use quantitative and qualitative analyses to identify experienced portfolio managers who specialize in specific asset classes. We monitor each component of the process to maintain and increase conviction in its ability to create sustaining long-term value.

|

|

||||

|

|

Values-Based Investing

Many people unknowingly invest in companies whose products or practices conflict with their personal values. As few as 1% of all assets stewarded by faith-based families are aligned with their values. Why is that? For most investors, they either didn’t know this was an option or weren’t sure how to get started.

We believe that a wise approach to investing allows you to both achieve your financial goals and align with your deepest core values. The OneAscent Collective Investment Trust series makes this a reality and provides a new choice inside of your plan's investment lineup.

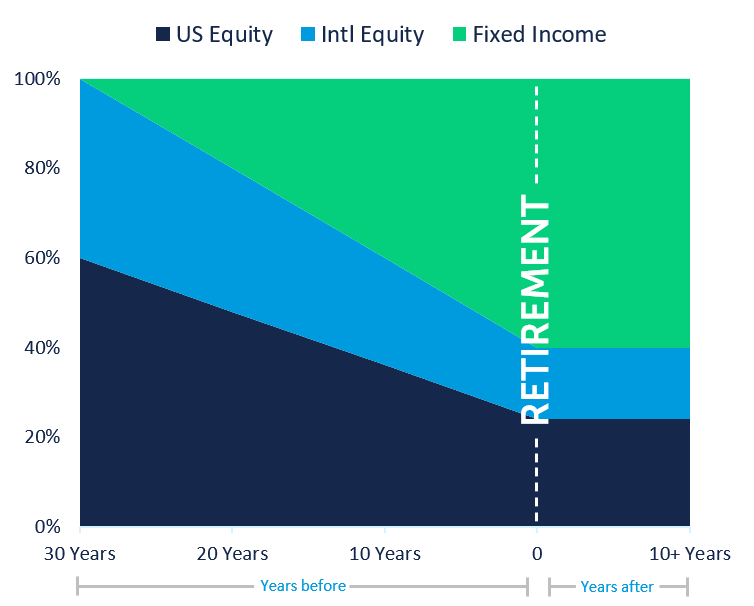

Target Date Approach

Target Date portfolios are professionally managed, diversified investment strategies designed to evolve as you near retirement. Each portfolio’s name typically includes a calendar year for simplified portfolio selection. Simply choose the portfolio dated nearest your “target year” — the year you plan to retire — and the rest is up to us. A Target Date portfolio’s guidepath shows how the exposure to stocks and other equities decreases over time. This process allows the portfolio to become more conservative as your retirement approaches.

OneAscent Collective Investment Trust

A collective investment trust (CIT) is a tax-exempt, pooled investment vehicle maintained by a bank or trust company. CITs are institutional investment vehicles designed for use within certain tax-qualified and governmental retirement plans. CITs can offer similar benefits to mutual funds at generally lower costs, making them an attractive option for plan sponsors.

For Professional Use Only

| Birth Year | Collective Fund | CUSIP | More Info |

| 1959 or before | OneAscent Target Retirement 2020 Fund | 68266T102 |

Learn More

|

| 1960 - 1969 | OneAscent Target Retirement 2030 Fund | 68266T201 |

Learn More

|

| 1970 - 1979 | OneAscent Target Retirement 2040 Fund | 68266T300 |

Learn More

|

| 1980 - 1989 | OneAscent Target Retirement 2050 Fund | 68266T409 |

Learn More

|

| 1990 or after | OneAscent Target Retirement 2060 Fund | 68266T508 |

Learn More

|

Contact OneAscent to learn more about values-based investing.

Alta Trust is a South Dakota chartered Trust company that acts as the Trustee of this Collective Investment Trust (CIT). Collective Investment Trusts are bank maintained and not registered with the Securities and Exchange Commission.

The Declaration of Trust describes the procedures for admission to and withdrawal from a CIT. The Declaration of Trust and the Fund’s Employee Benefit Summary should be read in conjunction with this information statement and is hereby incorporated by reference. The information contained in this statement is for informational purposes only and does not provide legal or tax advice. Any tax-related discussion contained in this information statement is not intended or written to be used, and cannot be used, for the purpose of (a) avoiding tax penalties or (b) promoting, marketing or recommending to any other party any transaction or matter addressed in this information statement.

Before investing in any Fund, please consider the Fund’s investment objective, strategies, risks, and expenses. Be sure to consult with your financial, legal and professional tax advisors prior to investment in any fund. Potential participants in any Fund may obtain a copy of the Employee Benefit Summary from the plan sponsor or from Alta Trust at info@trustalta.com.