OASC

OASC

OneAscent Small and Mid Cap ETF

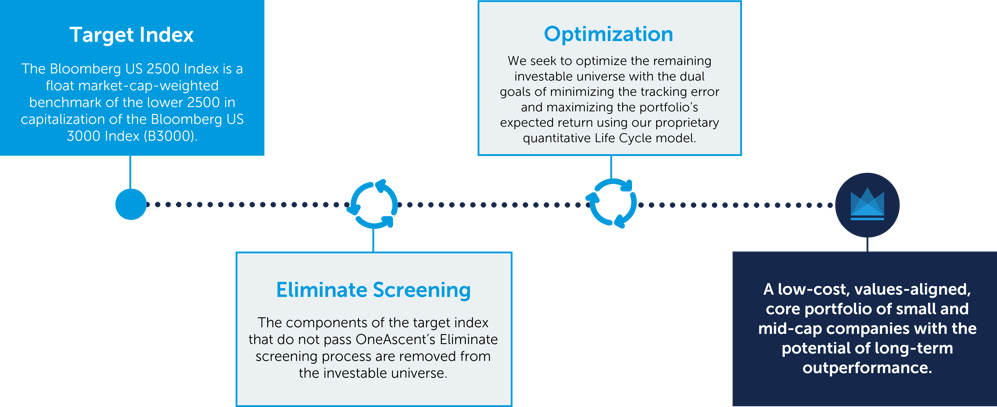

OneAscent Enhanced Small and Mid Cap ETF seeks to achieve enhanced returns over the Bloomberg US 2500 Total Return Index, before deduction of expenses, using an investment universe that is subjected to the OneAscent Values-Based Screening process.

Key Uniques:

![]()

Diversified Core U.S. Small and Mid-Cap Equity Exposure

OASC is constructed to be a core holding for equity portfolios by providing diversified access to U.S. small and mid-cap companies.

![]()

Index-Based Portfolio

OASC seeks to provide index-like returns by investing in a portfolio optimized to perform similar to the Bloomberg US 2500 Total Return Index.

![]()

Values-Aligned for Kingdom Impact

OASC uses a proprietary screening process to elevate companies that align with faith-based principles and positively impact the world.

| Fund Details | As of 12/6/2025 |

|---|---|

| Ticker | OASC |

| Primary Exchange | NYSE |

| CUSIP | 90470L295 |

| Inception Date | 6/13/2024 |

| Net Assets | $23,803,767.99 |

| Shares Outstanding | 925,000.00 |

| Gross Expense Ratio | 4.96% |

| Net Expense Ratio | 0.64% |

| Distribution Frequency | Annually |

| Fund Price | As of 12/6/2025 |

|---|---|

| NAV | $25.73 |

| Market Price | $25.76 |

| 30-day Median Bid/Ask Spread | 0.35% |

| Premium Discount | $0.03 |

Premium Discount is the amount the fund is trading above or below the reported NAV expressed as a percentage of the NAV. When the fund's market price is greater than the fund's NAV, it is said to be trading at a "Premium" and the percentage is expressed as a positive number. When the fund's market price is less than the fund's NAV, it is said to be trading at a "Discount" and the percentage is expressed as a negative number.

Historical Premium/Discount

| Year 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | |

|---|---|---|---|---|---|

| Days at premium | 84 | 46 | 30 | 38 | 25 |

| Days at discount | 23 | 10 | 11 | 13 | 7 |

The Premium/Discount shows the difference between the daily market price of the Fund’s shares and the Fund’s net asset value (“NAV”). Market price data reflects the official closing price. This data is provided for information purposes only and is not intended for trading purposes. Past performance does not guarantee future results.

Performance

As of 9/30/2025

Trailing Returns

| 3 Month | YTD | 1 Year | Since Inception | |

| OneAscent Small Cap Core ETF (Price) | 9.68% | 5.00% | 3.32% | 11.10% |

| OneAscent Small Cap Core ETF (NAV) | 9.73% | 5.00% | 3.43% | 11.10% |

| The Bloomberg US 2500 TR Index | 8.16% | 8.84% | 9.69% | 14.63% |

| S&P SmallCap 600 TR USD | 9.11% | 4.24% | 3.64% | 10.20% |

Fund NAV represents the closing price of underlying securities. Closing Market Price is calculated using the price which investors buy and sell ETF shares in the market. The Closing Market Price returns in the table were calculated using the closing price and account for distributions from the funds.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance current to the most recent month end, please call 1-800-222-8274.

The total fund operating expense is 4.96%. The Fund's advisor has contractually agreed to waive its management fee and/or reimburse the Fund's other expenses in order to limit total operating expenses to .64% through December 31, 2025.

The S&P SmallCap 600 Index is a stock market index that measures the performance of 600 small-cap companies in the U.S. It is designed to provide a benchmark for small-cap stocks and reflects the overall performance of this segment of the market.

The Bloomberg US 2500 Index is a float market-cap-weighted benchmark of the lower 2500 in capitalization of the Bloomberg US 3000 Index (B3000).

Effective 11/12/2025, the Fund’s name changed from the OneAscent Small Cap Core ETF to the OneAscent Enhanced Small and Mid Cap ETF and the Fund’s investment objective and principal investment strategies were changed to reflect that the Fund will seek to outperform the Bloomberg US 2500 Total Return Index, before deduction of expenses, using an investment universe that is subjected to the OneAscent Values-Based Screening process. As a result, the Fund’s benchmark index changed from the S&P SmallCap 600 TR USD to the Bloomberg US 2500 Total Return Index.

Source: Morningstar Direct

| Top 10 Holdings as of 12/6/2025 | Weight |

|---|---|

| 0.00% | |

| SPX TECHNOLOGIES | 1.04% |

| MR COOPER GROUP | 0.94% |

| FIRST HAWAIIA | 0.89% |

| CAVCO INDUSTRIES | 0.87% |

| LINCOLN NATL CRP | 0.87% |

| S & T BANCORP | 0.85% |

| UNITED COMMUNITY | 0.85% |

| BANCFIRST CORP | 0.84% |

| PIPER SANDLER CO | 0.83% |

| View all holdings (csv) |

As a percent of net assets. Portfolio Holdings are subject to change and should not be considered investment advice. Current and future portfolio holdings are subject to risk.

Investors should carefully consider the investment objectives, risks, and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 1-800-222-8274 or clicking the link above. The fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC, which is not affiliated with OneAscent Investment Solutions, LLC.

Important Risk Information:

Exchange-traded funds involve risk including the possible loss of principal. Past performance does not guarantee future results.

The Adviser invests in securities only if they meet both the Fund's investment and values-based screening requirements, and as such, the returns may be lower than if the Adviser made decisions based solely on investment considerations.

The Fund faces numerous market trading risks, including the potential lack of an active market for Fund sharers, losses from trading in secondary markets, and periods of high volatility and disruption in the creation/redemption process of the Fund. These factors may lead to the Fund's shares trading at a premium or discount to NAV.

High conviction is a style of active management that is expressed through portfolio construction. Without deploying a consistent high-conviction approach over time, it is hard for any manager to beat the benchmark or passive fund equivalent for their target sector.

The fund contains international securities that may provide the opportunity for greater return but also have special risks associated with foreign investing including fluctuations in currency, government regulation, differences in accounting standards and liquidity.

Securities of companies with small market capitalizations are often more volatile and less liquid than investments in larger companies. Small cap companies may face a greater risk of business failure, which could increase the volatility of the Fund’s portfolio.

Additional risks are included in the Fund prospectus.

The S&P SmallCap 600® seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable.