OAIM

OAIM

OneAscent International Equity ETF

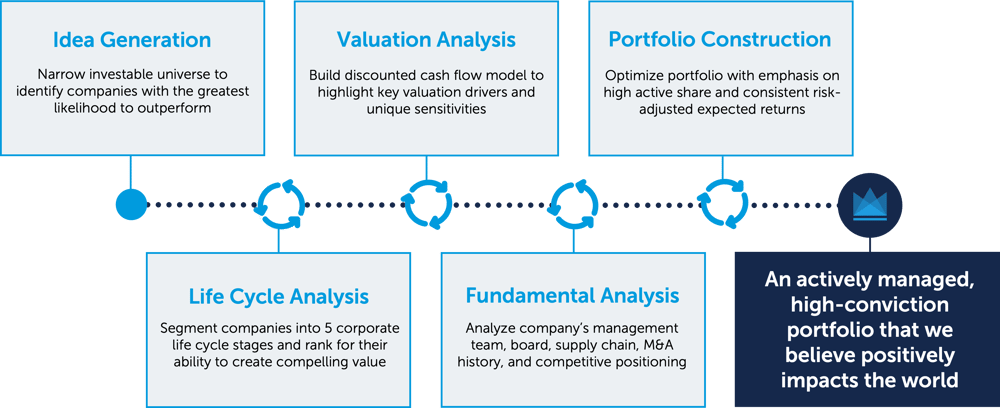

The OneAscent International Equity fund takes an innovative approach to international investing. The strategy combines the OneAscent Elevate Screening Process along with the investment team’s Life Cycle Investment approach. The team conducts extensive fundamental analysis to arrive at a concentrated portfolio of companies it believes could be more likely to outperform.

Key Uniques:

![]()

A Focus on Societal Impact

With the help of the OneAscent Elevate Screening methodology, the investment team seeks out those companies around the world that are providing goods or services that advance the flourishing of society. A deep dive into a company’s business model, stakeholder policies, and overall community impact helps to eliminate those companies that do not share our values and thereby allowing the team to focus on companies in which our clients can be proud to own.

![]()

Unique Fundamental Framework

The investment team believes companies go through a natural corporate “Life Cycle” and understanding where a company lies along that spectrum is central to the fundamental investment process. With the help of quantitative tools, the team is able to segregate the investment universe into life cycle stages and attempt to more accurately identifying a company’s real asset growth and return on invested capital. Using this lens, the team applies a rigorous fundamental analysis process to help identify those companies more likely to create ongoing shareholder value.

![]()

Experienced Global Investment Team

The investment team is led by a portfolio manager with decades of investment experience in global equity markets. The team manages multiple, high conviction portfolio using the same rigorous bottom-up investment process.

| Fund Details | As of 12/1/2025 |

|---|---|

| Ticker | OAIM |

| Primary Exchange | NYSE Arca |

| CUSIP | 90470L436 |

| Inception Date | 9/15/22 |

| Net Assets | $202,201,111.99 |

| Shares Outstanding | 5,600,000.00 |

| Gross Expense Ratio | 0.99% |

| Net Expense Ratio | 0.95% |

| Distribution Frequency | Annually |

| Fund Price | As of 12/1/2025 |

|---|---|

| NAV | $36.11 |

| Market Price | $36.38 |

| 30-day Median Bid/Ask Spread | 0.44% |

| Premium Discount | $0.27 |

Premium Discount is the amount the fund is trading above or below the reported NAV expressed as a percentage of the NAV. When the fund's market price is greater than the fund's NAV, it is said to be trading at a "Premium" and the percentage is expressed as a positive number. When the fund's market price is less than the fund's NAV, it is said to be trading at a "Discount" and the percentage is expressed as a negative number.

Historical Premium/Discount

| Year 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | |

|---|---|---|---|---|---|

| Days at premium | 186 | 45 | 17 | 21 | 257 |

| Days at discount | 57 | 9 | 26 | 9 | 170 |

The Premium/Discount shows the difference between the daily market price of the Fund’s shares and the Fund’s net asset value (“NAV”). Market price data reflects the official closing price. This data is provided for information purposes only and is not intended for trading purposes. Past performance does not guarantee future results.

Performance

As of 9/30/2025

Trailing Returns

| 3 Month | YTD | 1 Year | 3 Year | Since Inception | |

| OneAscent International Equity ETF (Price) | 5.32% | 25.22% | 19.68% | 22.22% | 18.80% |

| OneAscent International Equity ETF (NAV) | 5.24% | 25.17% | 19.50% | 22.31% | 18.76% |

| MSCI ACWI ex USA Index | 6.89% | 26.02% |

16.45% |

20.67% |

16.83% |

Fund NAV represents the closing price of underlying securities. Closing Market Price is calculated using the price which investors buy and sell ETF shares in the market. The Closing Market Price returns in the table were calculated using the closing price and account for distributions from the funds.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance current to the most recent month end, please call 1-800-222-8274.

The total Fund operating expense is 0.99%. The Fund’s adviser contractually has agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses, do not exceed 0.95% through December 31, 2025.

Source: Morningstar Direct

Elevate Stories

When a company elevates every single person and every square inch, they create stories worth sharing.

Below are examples from this fund.

Intertek Group PLC

According to the Global Slavery Index, more than 46 million people worldwide live in modern slavery.1

Intertek elevates fair labor

by offering preventative solutions.

Intertek offers complete solutions to help organisations not only meet the requirements of global Modern Slavery Acts, but to ensure a safe environment for all those working in their supply chain. This is done through internal support, Workplace Assessments, training programs, Social Compliance Audit Services, and Intertek Inlight.

Webuild SPA

More than 2 billion people do not have safe drinking water available, leading to 1,000 child deaths per day.2

Webuild SPA is a global leader in water treatment and waste management. Its water projects consist of reverse osmosis desalination and thermal desalination plants having served over 20 million people.

Vinci SA

Morocco currently faces an energy shortage due to its heavy reliance on imported fossil fuels, importing around 90% of its energy needs, leaving it vulnerable to price fluctuations and supply disruptions.3

In Morocco, Vinci Construction is building the Abdelmoumen pumped storage energy transfer station. Compensating for the intermittency of renewable energy sources, this structure stores electrical energy in hydraulic form when demand is low, and releases it when demand increases, smoothing out supply disruption and limiting price volatility.

Indra Sistemas

Many public services and critical national infrastructures—such as transportation networks, air‐traffic control, and defense systems—struggle to modernize quickly enough to meet the demands of growing populations and evolving security challenges.

Indra accelerates digital transformation of essential services by delivering cutting-edge technology for air traffic management, smart transport, and defense modernization. The company designs and deploys advanced control and automation systems that help airports reduce delays and fuel burn, enable rail networks to run more efficiently, and support governments in protecting critical infrastructure.

Enel

Traditional power plants emit pollutants such as sulfur dioxide, nitrogen oxides, carbon dioxide, and mercury causing cancer, respiratory problems, cardiovascular problems.5

Enel has built the first floating photovoltaic plant, using part of a large service reservoir at a hydroelectric power plant that has been in operation since the late 1960s. The solar and hydropower hybrid plant creates clean, sustainable, efficient electricity with no impact to the landscape as the plant floats on the already existing artificial reservoir

| Top 10 Holdings as of 12/1/2025 | Weight |

|---|---|

| 0.00% | |

| Indra Sistemas SA | 4.20% |

| KBC GROUP | 3.63% |

| HEIDELBERG MATER | 3.25% |

| MITSUB ELEC CORP | 3.05% |

| CRH PLC | 2.91% |

| NOMURA RESEARCH | 2.87% |

| VINCI SA | 2.86% |

| ALPHA SERVICES A | 2.67% |

| TSMC | 2.66% |

| View all holdings (csv) |

As a percent of net assets. Portfolio Holdings are subject to change and should not be considered investment advice. Current and future portfolio holdings are subject to risk.

Investors should carefully consider the investment objectives, risks, and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 1-800-222-8274 or clicking the link above. The fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC, which is not affiliated with OneAscent Investment Solutions, LLC.

Important Risk Information:

Exchange-traded funds involve risk including the possible loss of principal. Past performance does not guarantee future results.

The Adviser invests in securities only if they meet both the Fund's investment and values-based screening requirements, and as such, the returns may be lower than if the Adviser made decisions based solely on investment considerations.

The Fund faces numerous market trading risks, including the potential lack of an active market for Fund sharers, losses from trading in secondary markets, and periods of high volatility and disruption in the creation/redemption process of the Fund. These factors may lead to the Fund's shares trading at a premium or discount to NAV.

High conviction is a style of active management that is expressed through portfolio construction. Without deploying a consistent high-conviction approach over time, it is hard for any manager to beat the benchmark or passive fund equivalent for their target sector.

The fund contains international securities that may provide the opportunity for greater return but also have special risks associated with foreign investing including fluctuations in currency, government regulation, differences in accounting standards and liquidity.

1Source: Olympus Corp: Mohammad Javad Zahedi, Sara Shafieipour, Mohammad Mahdi, et al. “Mortality Trends of Gastrointestinal, Liver, and Pancreaticobiliary Diseases: A Hospital-Based Prospective Study in the Southeast of Iran.” NIH.

2Source: https://www.theguardian.com/environment/2024/oct/16/global-water-crisis-food-production-at-risk

3Source: https://www.trade.gov/country-commercial-guides/morocco-energy

4Source: https://pmc.ncbi.nlm.nih.gov/articles/PMC1121189/#:~:text=Across%20all%20disciplines%2C%20at%20all,care%20is%20becoming%20more%20complex; https://www.wipo.int/en/web/economics/w/blogs/which-are-the-world-s-most-complex-capabilities

5Source: https://www.epa.gov/power-sector/power-plants-and-neighboring-communities#:~:text=description%20and%20download-,Overview,Hg)%2C%20and%20other%20pollutants