OACP

OACP

OneAscent Core Plus Bond ETF

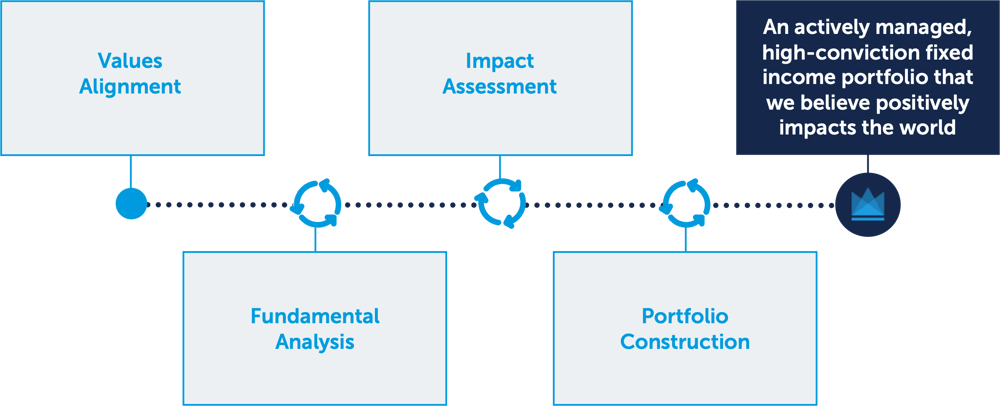

The OneAscent Core Plus Bond ETF (OACP) seeks total return, with an emphasis on income as the source of that total return, while giving special consideration to certain values-based and impact criteria.

Key Uniques:

![]()

Diversify Traditional Fixed Income Allocations

OACP is constructed to be a core fixed income portfolio holding by providing diversified US fixed income holdings, including non-benchmark exposure to bonds rated below investment grade, non-US dollar and emerging markets.

![]()

Add Alpha and Manage Risk Over Market Cycles

OACP is designed and actively managed to seek to deliver attractive, risk-adjusted returns. The Fund leverages the scale, deep sector expertise, and embedded risk management process of its Sub-Adviser.

![]()

Align with Values, Elevate for Impact

OACP seeks to elevate issuers that demonstrably and consistently promote flourishing for their communities, environments, and stakeholders. We believe that Impact should be direct and measurable.

| Fund Details | As of 12/6/2025 |

|---|---|

| Ticker | OACP |

| Primary Exchange | NYSE Arca |

| CUSIP | 90470L519 |

| Inception Date | 3/30/22 |

| Net Assets | $166,400,514.48 |

| Shares Outstanding | 7,400,000.00 |

| Gross Expense Ratio | 0.74% |

| Net Expense Ratio | 0.74% |

| Distribution Frequency | Monthly |

| Fund Price | As of 12/6/2025 |

|---|---|

| NAV | $22.49 |

| Market Price | $22.52 |

| 30-day Median Bid/Ask Spread | 0.04% |

| Premium Discount | $0.03 |

| As of 11/30/2025 | |

|---|---|

| 30-Day SEC Yield | 4.43% |

Premium Discount is the amount the fund is trading above or below the reported NAV expressed as a percentage of the NAV. When the fund's market price is greater than the fund's NAV, it is said to be trading at a "Premium" and the percentage is expressed as a positive number. When the fund's market price is less than the fund's NAV, it is said to be trading at a "Discount" and the percentage is expressed as a negative number.

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ending 11/30/2025, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period.

Historical Premium/Discount

| Year 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | |

|---|---|---|---|---|---|

| Days at premium | 164 | 45 | 17 | 21 | 257 |

| Days at discount | 32 | 9 | 26 | 9 | 170 |

The Premium/Discount shows the difference between the daily market price of the Fund’s shares and the Fund’s net asset value (“NAV”). Market price data reflects the official closing price. This data is provided for information purposes only and is not intended for trading purposes. Past performance does not guarantee future results.

Performance

As of 9/30/2025

Trailing Returns

| 3 Month | YTD | 1 Year | 3 Year | Since Inception | |

| OneAscent Core Plus Bond ETF (Price) | 2.33% | 6.10% | 3.07% | 5.37% | 1.73% |

| OneAscent Core Plus Bond ETF (NAV) | 2.33% | 5.96% | 3.03% | 5.33% | 1.70% |

| Bloomberg US Aggregate Bond Index | 2.03% | 6.13% | 2.88% | 4.93% | 1.39% |

Fund NAV represents the closing price of underlying securities. Closing Market Price is calculated using the price which investors buy and sell ETF shares in the market. The Closing Market Price returns in the table were calculated using the closing price and account for distributions from the funds.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance current to the most recent month end, please call 1-800-222-8274.

The total fund operating expense is 0.74%.

Source: Morningstar Direct

Elevate Stories

When a company elevates every single person and every square inch, they create stories worth sharing.

Below are examples from this fund.

The Republic of Colombia

From the 1960s until 2016, the country of Colombia fought against the FARC. In the United States, this conflict is primarily associated with the War on Drugs.1

This bond integrates former FARC members into non-violent government and societal participation, providing economic alternatives to drug cultivation. Eligible spending categories for this bond include housing and infrastructure, poverty reduction, improving education and healthcare services, and ending hunger and malnutrition.

Women's Livelihood Bond Series

Globally, 383 million women and girls live on less than $2 per day.2

This bond’s proceeds will be distributed to nine borrowers in SE Asia and Africa to help transition nearly 900,000 women from subsistence to sustainable livelihoods through access to credit, market linkages, and affordable goods.

Freddie Mac

Only 36 available and affordable rental units exist for every 100 extremely low-income renter households.3

This bond creates housing opportunities for those with high affordability needs by financing/refinancing obligations related to a senior living multifamily facility in Tucson, Arizona. 79 percent of the renters are very or extremely low income, yet the facility provides meals, housekeeping, and transportation.

Duke Energy Carolinas

Grids will need to become both more resilient and greener if they are to sustain increased demand 'sustainably.'4

In order to increase power grid generation while meeting variable demand curves and emission targets, this bond’s proceeds will fund energy efficiency, distribution, and storage initiatives nationwide. Duke estimates that such efforts reduced 75 million minutes of customer power outages in 2023.

IBRD

Sixty percent of Vietnam does not have sufficient access to safe water and sanitation.5

This bond elevates communities by providing access to clean water for Vietnam children. This International Bank for Reconstruction and Development project aims to manufacture 300,000 water purifiers, distribute them to

approximately 8,000 schools across Vietnam, and make clean water available to around 2,000,000 children.

| Top 10 Holdings as of 12/6/2025 | Weight |

|---|---|

| 0.00% | |

| T 4 1/4 05/15/35 | 1.97% |

| US DOLLARS | 1.60% |

| T 3 7/8 04/30/30 | 1.30% |

| FN MA4626 | 1.26% |

| FN MA5165 | 1.23% |

| FN MA4580 | 1.21% |

| FN FS1533 | 1.20% |

| FN MA5353 | 1.19% |

| FN MA4579 | 1.17% |

| View all holdings (csv) |

As a percent of net assets. Portfolio Holdings are subject to change and should not be considered investment advice. Current and future portfolio holdings are subject to risk.

Investors should carefully consider the investment objectives, risks, and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 1-800-222-8274 or clicking the link above. The fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC, which is not affiliated with OneAscent Investment Solutions, LLC.

Important Risk Information:

Exchange-traded funds involve risk including the possible loss of principal. Past performance does not guarantee future results.

The Adviser invests in securities only if they meet both the Fund's investment and values-based screening requirements, and as such, the returns may be lower than if the Adviser made decisions based solely on investment considerations.

The Fund faces numerous market trading risks, including the potential lack of an active market for Fund sharers, losses from trading in secondary markets, and periods of high volatility and disruption in the creation/redemption process of the Fund. These factors may lead to the Fund's shares trading at a premium or discount to NAV.

Diversification does not ensure a profit or guarantee against loss.

1Source: Klobucista, Claire, and Danielle Renwick. “Colombia’s Civil Conflict.” Council on Foreign Relations.

2Source: Azcona, Ginette, and Antra Bhatt. “Poverty Is Not Gender-Neutral.” SDG Action.

3Source: “The GAP.” National Low Income Housing Coalition.

4Source: “Sources of Greenhouse Gas Emissions.” United States Environmental Protection Agency.

5Source: Nuveen. “Green Bond: Water Purification.” YouTube.