Key Events: Signs of slowing

Manufacturing surveys and job openings data indicated slowing economic momentum. Friday’s weak job creation data included downward revisions to recent job creation numbers, kicking September off on a dreary note.

The better-than-expected unemployment rate failed to allay the week’s heightened recession worries.

Market Review: Post-summer hangover

Recession fears drove small cap stocks down 5.7% while the S&P 500 dropped 4.2%; international stocks losses were slightly smaller. Value held up better than growth across the market cap spectrum; Consumer Staples was the only sector that gained on the week.

Bonds gained on increased recession fears and expectations regarding the amount of rate cuts.

Outlook: Trying to stick the landing

The Fed is in the process of trying to execute a soft landing, a feat as hard to achieve as a perfect 10 in gymnastics. It rarely happens; most hard landings (recessions) start off as soft landings.

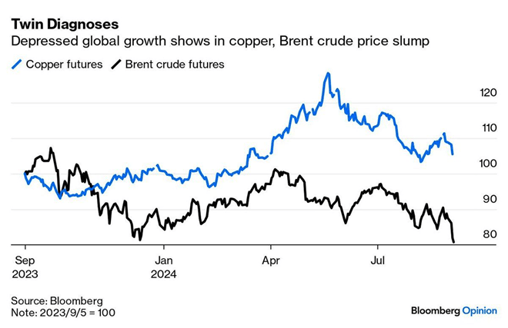

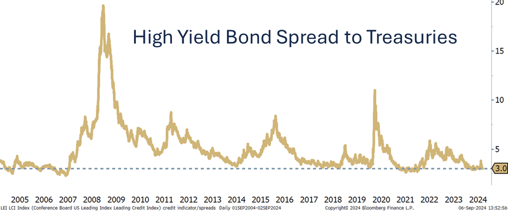

Conflicting signals from normally reliable indicators aren’t making the Fed’s job any easier. The two charts below highlight two discordant indicators: Copper price declines usually signal a global downturn, which has earned it the moniker “Dr. Copper” because it is said to have a PhD in economics. High yield (junk bond) premiums, however, are near the lowest levels of the last 20 years, indicating the bond market is not worried about the economy.

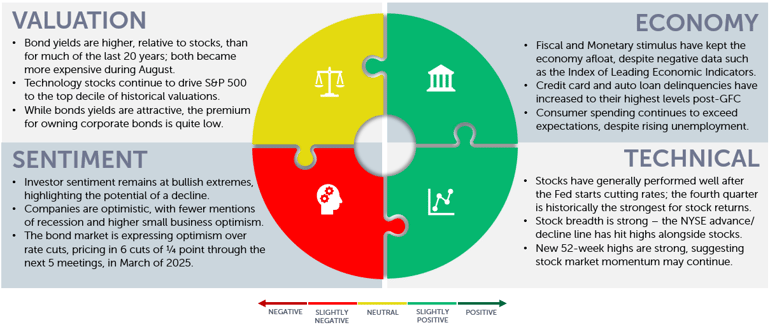

Given these two well-known and contrary signals and the increase in market volatility, our advice is to remain diversified, but fully invested, without placing too much emphasis on one economic outcome.

Dr. Copper: Diagnosis Recession [1]

High Yield isn’t worried [2]

Navigator Outlook: September 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

[2] Source: Bloomberg US Corporate High Yield Spread

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00936