Key Events: ”We’ll know it when we see it.”

This was Federal Reserve Governor Powell’s response when asked how he’ll know that Fed policy is sufficiently restrictive to tame inflation and achieve a soft landing.

The economy faces three challenges in the coming weeks:

1. A contentious autoworkers strike

2. A likely government shutdown

3. Resumption of student loan payments.

Market Review: A complacent market hits some potholes

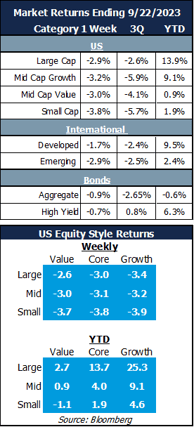

The stock market didn’t like Governor Powell’s words, with most markets losing a couple percentage points. Bonds lost ground as the market reacted to an uptick in inflation, driven in part by energy prices. Oil is trading above $90, an increase of 25% over the last three months.[1]

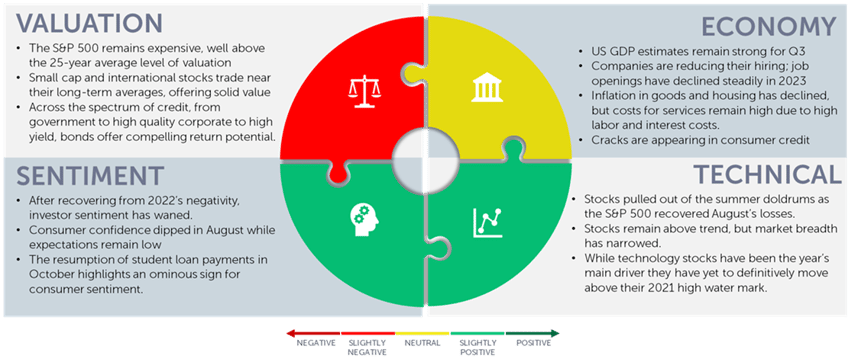

Outlook: Staying vigilant

While the market struggles with near-term volatility, we look to position portfolios to benefit from potential gains while limiting downside exposure. Part of how we do that is by being aware of what the market is telling us.

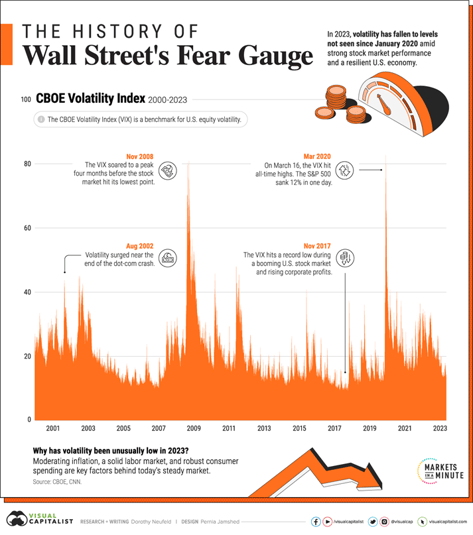

As can be seen below, Wall Street’s “fear gauge,” the VIX, has been declining this year. Another proxy for risk attitudes is the spread high-yield bonds pay over the yield of treasury bonds. That yield premium has drifted lower in recent weeks, indicating to us that the high yield market is also not particularly worried about risk.[2]

To quote Warren Buffett, history teaches us to “be fearful when others are greedy and greedy when others are fearful.” That applies to the complacency we see today. We remain cautious but fully invested in a diversified allocation, ready to take advantage of the opportunities a volatile market may provide.

Wall Street’s Fear guage is low[3]

Navigator Outlook: September 2023

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

[2] Source: Federal Reserve Bank of St. Louis

[3] Source: Charted: Market Volatility at its Lowest Point Since 2020 (visualcapitalist.com)

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggretate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00426