Key Events: Slowing growth met with rate cuts

The Federal Reserve dialed down proposals for bank capital requirements...on the same day several banks signaled expectations for worsening loan performance.

The European Central Bank cut interest rates this week and the markets are pricing aggressive US Federal Reserve rate cuts due to slowing economic growth.

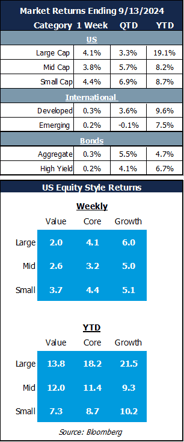

Market Review: A sharp recovery for momentum stocks

Increased expectations for rate cuts drove momentum stocks higher – technology gained 7%. Momentum also drove the S&P 500 to its best week of 2024, a rebound from the worst week of 2024 just last week.

International stocks treaded water as recession fears increased, while bonds gained slightly leading into next week’s Fed meeting.

Outlook: Will rate cuts propel the market forward?

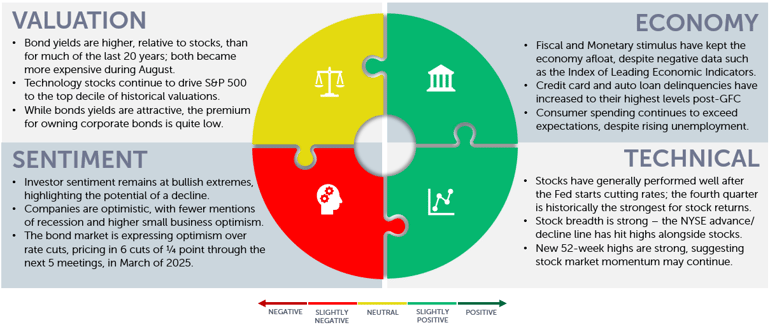

Stocks seized on increased rate cut expectations and hope that the Fed would be able to avoid a recession, leading to solid gains. Are they likely to continue?

We pointed out some negative economic signals last week, but this week let’s touch on some near-term catalysts for further momentum (See the charts below):

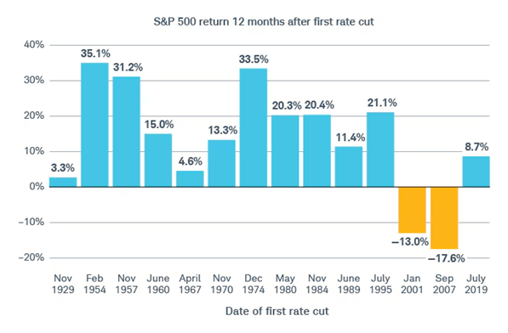

- Stocks often gain after the fed begins cutting rates.

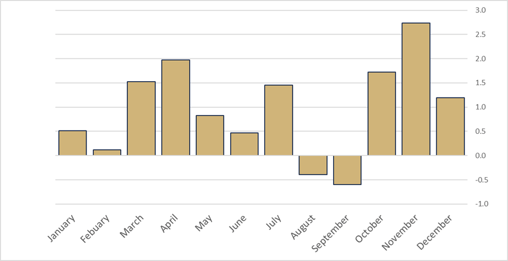

- While September is, on average, the worst month for stock market performance, the fourth quarter is the best three-month period.

While there is risk of increased volatility as the election nears and increased recessionary risk, these signals should lead investors to some level of confidence. Our advice is to remain diversified, but fully invested, without placing too much emphasis on the election.

Stocks Like Interest Rate cuts [1]

Stocks Favor the Fourth Quarter [2]

Navigator Outlook: September 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Schwab Asset Management How Will the Market Respond to Rate Cuts? | Charles Schwab

[2] Source: Bloomberg, OneAscent Investment Solutions

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00944