Key Events: Weak links appear in the economic chain

The Cleveland Fed reports that inflation forecasts are ticking up, driven at least partially by energy prices[1]; oil prices remain near their 2023 highs.

Tensions continue to increase between the UAW and auto makers following significant wage increases negotiated by UPS drivers and airline pilots this summer. Negotiations are taking place among the economic backdrop of increasing delinquency rates in auto and credit card loans, early signs of stress in the consumer sector.

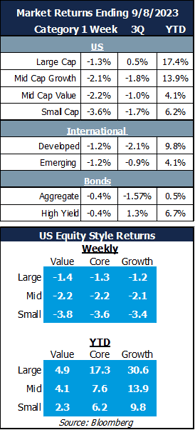

Market Review:Continued declines

Last week’s market declines continued this week. Stocks fell across the board, with smaller cap stocks losing more than large cap or international stocks.

Bonds lost money as upward pressure on interest rates continued. Yields remain close to 2023 peak levels.

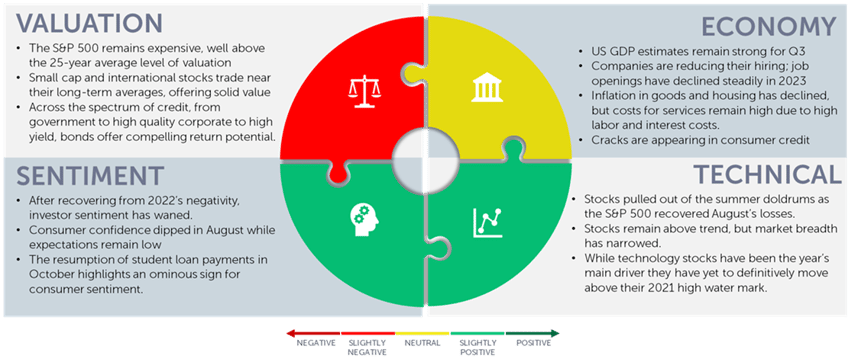

Outlook: The volatility we’ve been expecting

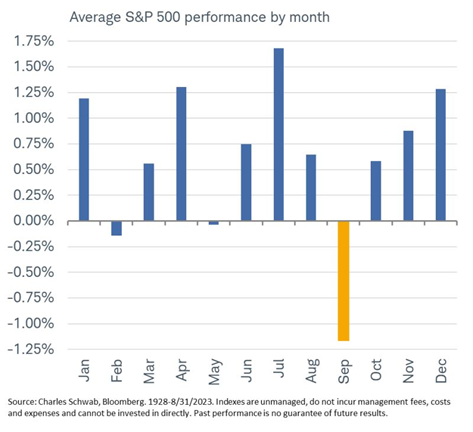

September is historically the worst month of the year and Stocks are already down a couple percent so far in 2023. When the market is up 10% or more through the end of August, though – as it was this year – history shows us the S&P 500 has gained 2% on average during September.[2]

History teaches us that returns are volatile in the short term, so we do not try to predict them. Rather, we encourage investors to remain fully invested in a diversified portfolio that meets the needs of their financial plan; we are finding attractive opportunities in stock and bond markets today.

September Stock Market Expectations

Navigator Outlook: September 2023

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Cleveland Federal Reserve Bank Inflation Nowcasting (clevelandfed.org)

[2] Source: Bespoke Investment Group

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggretate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00421