Key Events: Goldilocks (?)

Employment news highlighted pressures on consumers (spending power) and corporations (profit margins):

- The August increase in hiring exceeded expectations, but job openings have declined over the last 18 months.

- The UAW strike continued, and more than 75,000 healthcare workers walked off the job this week as workers seek higher wages and benefits.

Market Review: Recovery from the pullback

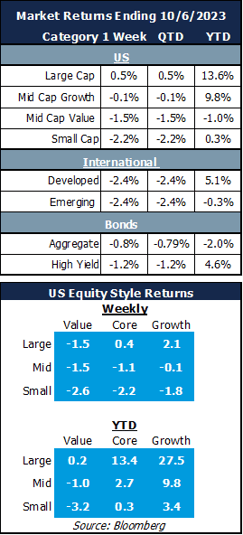

After four down weeks, the S&P 500 recovered to end the week with a slightly positive return. Small cap and international stock markets, however, finished in the red.

Bonds lost ground as the market re-set rate expectations yet again; the 10-year treasury closed at a 4.79% yield.

Outlook: An uncertain future – just ask the experts

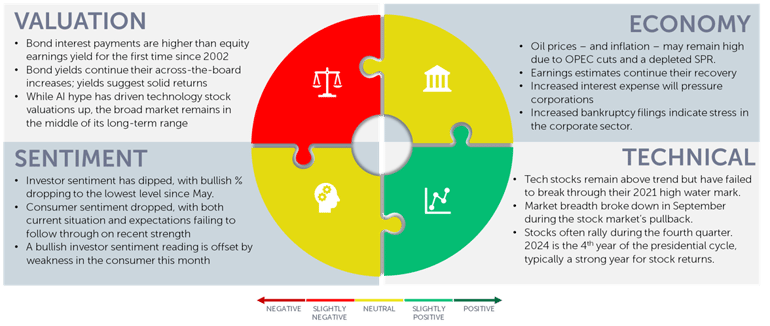

This week marked the third drawdown of 7% since the October 2022 market low. Stocks were down four weeks in a row, and 9 out of the last 11[1]. Such downturns are a healthy, normal part of being invested in the stock market.

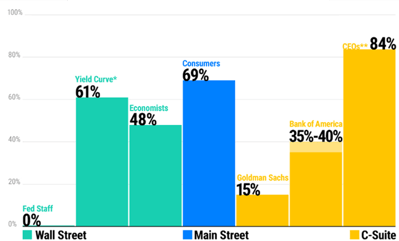

Seasonal factors give us some optimism; the fourth quarter has historically seen the strongest stock returns[2]. As the chart below illustrates, however, the outlook remains cloudy, with little clarity regarding the pending recession.

OneAscent remains fully invested and has made a slight shift out of smaller cap names to larger, dividend-focused holdings. Despite Federal Reserve confidence of avoiding a recession, higher interest rates have increased the risk of further stock pullbacks.

Will the U.S. Get Hit With a Recession in 2024?[3]

Navigator Outlook: October 2023

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg

[2] Source: Bloomberg, OneAscent Investment Solutions – Data consists of the last 30 years of monthly returns ended September 2023

[3] Source: Visual Capitalist Will the U.S. Get Hit With a Recession in 2024? (visualcapitalist.com)

*Based on a New York Fed model estimating recession probabilities using 10-year minus 3-month Treasury yield spreads, based on data from 1959-2009

** Conference Board Q3 CEO Survey Probability of a recession over the next 12-18 months.

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggretate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00433