Key Events: Blowout jobs data

September jobs growth beat forecasts significantly, the unemployment rate unexpectedly declined, and wage growth accelerated, increasing optimism and reducing the odds of a second 50 bps rate cut in November.

The middle east conflict escalated as Israel launched ground and missile attacks on Hezbollah in Lebanon.

Market Review: Rethinking rate cuts

The bond market reacted to the positive economic data by lowering the odds of a ½ % rate cut at the next Fed meeting and causing bonds to sell off 1.2%.

Stock returns reflected changing expectations as well; returns reversed last week’s trend as the S&500 outperformed international, small to mid-cap stocks, and high yield bonds. Emerging market stocks were the leader as China rolled out multiple stimulus measures.

Outlook: Recession or not? That is the key.

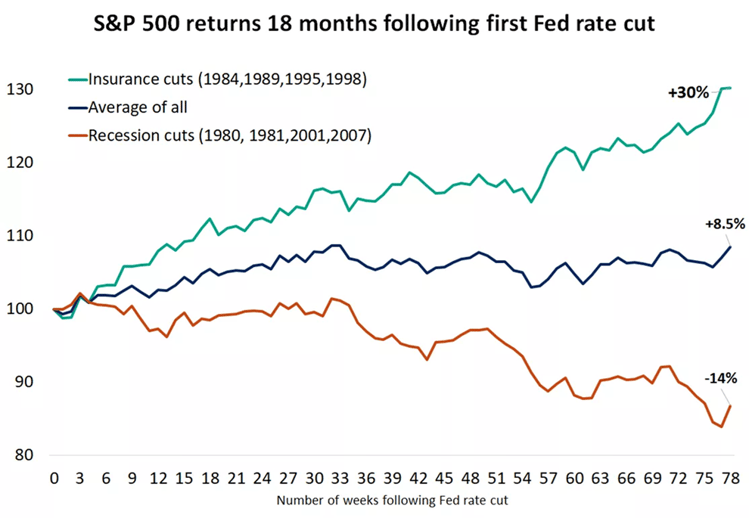

The below chart illustrates how rate cuts affect the stock market; the key factor is recession:

- If the Fed can engineer a soft landing, that may suggest strong stock returns going forward.

- If it turns out the economy cannot avoid a recession we should expect significant stock volatility.

Soft landings – the markets expectation - are rare and difficult to achieve. We must account for the potential of recession as well as re-emergence of inflationary fears. Our portfolios are fully invested in a diversified portfolio of assets which gives us good profit opportunities while offering some protection in a negative outcome.

Rate Cuts: Recession or not? [1]

Navigator Outlook: October 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Edward Jones Weekly market wrap | Edward Jones

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00950