Key Events: Profit margins fall, as does the British Prime Minister

Key Events: Profit margins fall, as does the British Prime Minister

With 20% of the S&P 500 companies reporting, the blended earnings growth rate is 1.5%, the lowest since the pandemic. Profit margins have now fallen for five straight quarters.[1] On Friday, the market interpreted San Francisco Fed President Mary Daly’s comments to mean rates might rise slower. International news kept the market participants on edge. After failing to implement her economic policies Liz Truss, the UK Prime Minister, resigned after 45 days - the shortest PM tenure in Great Britain’s history. Russia again pounded Ukraine with missiles and continued inflammatory rhetoric. Chinese President Xi Jinping secured a third term as the country’s leader.

Market Review: Ending on a positive note

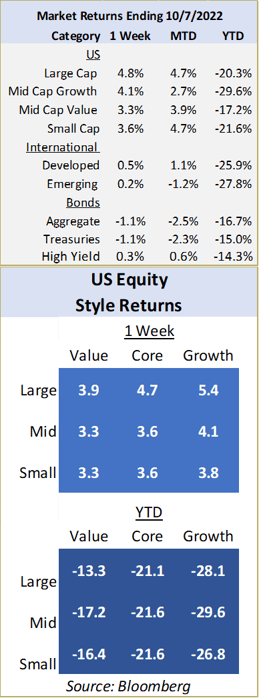

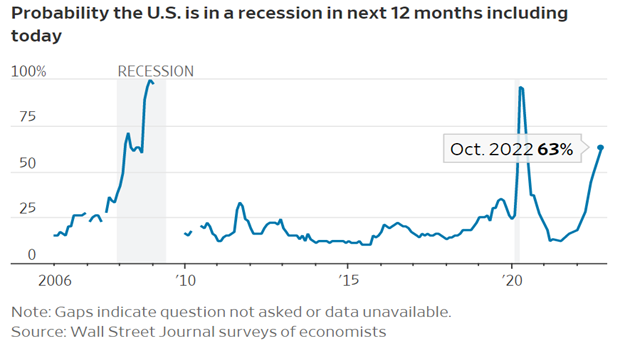

As seen in the chart below from The Wall Street Journal, recession probabilities continue to increase. Despite that, markets both started and ended the week on a positive note. The S&P 500 rose 4.8% for the week as growth stocks led the way while international stocks had muted returns. Investment grade bonds lost ground as the ten-year treasury yield rose to 4.2% from 4.0% at the end of the prior week.

Outlook: Earnings season and more volatility

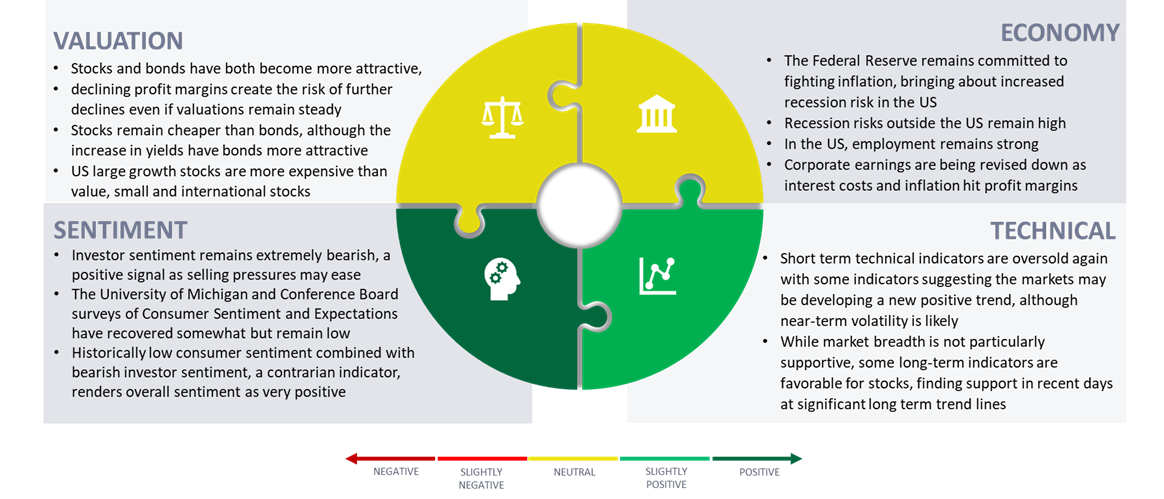

Stocks appear inexpensive based on the price relative to next year’s earnings; this week will provide some clarity as 30% of the S&P 500 report their earnings. We will be watching for signs of margin pressures from increased commodity prices and interest rates, as well as for signs of a consumer slowdown. Additionally, the market is likely to look towards the mid-term elections for signs of direction. We caution that despite some short-term volatility, the US elections do not usually have as significant an impact on returns as many investors fear. The market generally likes a divided government, as policy stability is likelier in that scenario.

Source: 1) Source: Factset Earnings Insight

Navigator Outlook: October 2022

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00050