Key Events: Signs of strength – for the most part

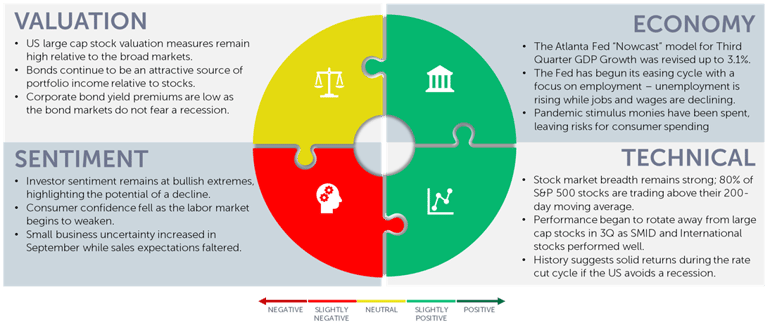

The Atlanta Fed 3Q GDP estimate rose to 3.4%. Reporting season kicked off with almost 4 out of 5 companies[1] beating EPS estimates. Retail sales beat expectations, affirming the strength of the consumer.

Geopolitical conflict escalated as China ramped up military drills around Taiwan and Israel Characterized the killing of Yahya Sinwar as “the beginning of the end” - not the end - of the war.

Market Review: Responding to growth

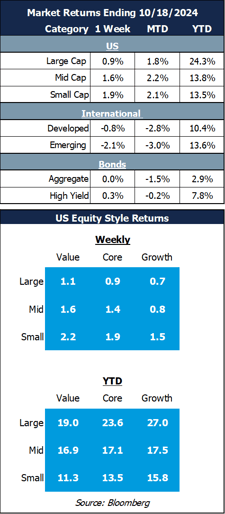

US Stocks turned in strong gains as growth estimates increased but emerging markets dropped again on skepticism of Chinese stimulus measures.

Bond returns were muted this week, anticipating more earnings and economic data next week.

Outlook: More evidence of economic strength

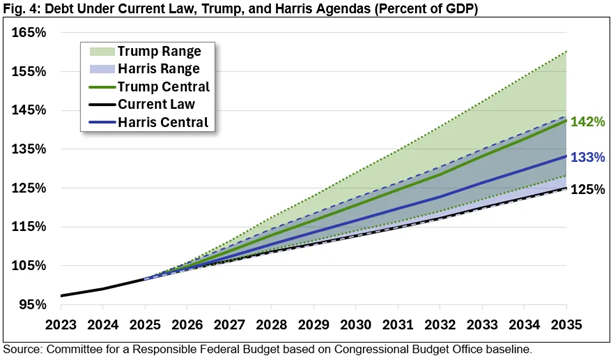

We are taking a slightly cynical view regarding the elections. The most important thing to understand is not which sectors will perform best under Trump or Harris, but that the deficit will continue to balloon under both Harris’ and (worse) Trump’s plan.

This is bad for the long-term health of our nation. Please vote for fiscally responsible politicians.

In the short term these deficits will stimulate the economy; this is evident in the data and earnings forecasts. It is partly why we have, somewhat begrudgingly, remained fully invested in a diversified set of assets rather than lowering the risk profile of portfolios. We don’t read too much into expectations for market returns based on the election; rather we urge investors to stay disciplined and stay invested.

The election – outlook for the US fiscal deficit [2]

Navigator Outlook: October 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: FactSet – with 14% of S&P 500 companies reporting, 79% have beat earnings estimates and 64% have beat revenue expectations.

[2] Source: Committee for a responsible budget The Fiscal Impact of the Harris and Trump Campaign Plans-Mon, 10/07/2024 - 12:00 | Committee for a Responsible Federal Budget (crfb.org)

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00968