After initially falling early in the week, equity markets crawled back into positive territory by the end of week despite a weaker than expected jobs report on Friday. The US economy added 194,000 jobs in September, which dropped the unemployment rate to 4.8%. However, analysts were expecting 500,000 jobs to have been added, and the unemployment rate dropping was partially attributable to a decline in labor participation, so the news was disappointing[1]. The S&P 500 (a proxy for US large-cap stocks) ended up rising 0.8% for the week while the MSCI ACWI index (a proxy for global stocks) gained 0.7%[2].

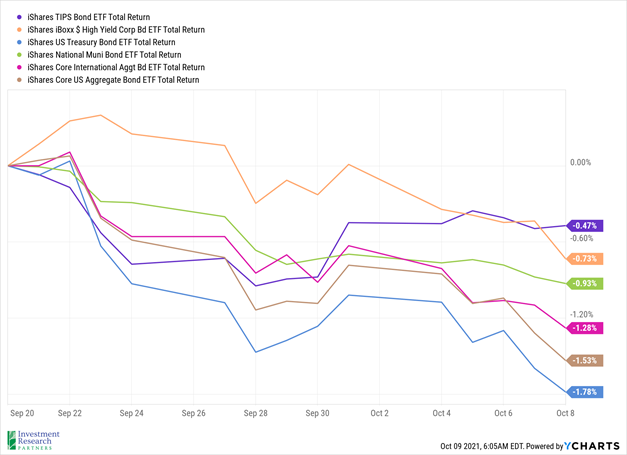

As equity market volatility has risen somewhat in the past two months, investors may not be paying as much attention to bond markets. Historically, investors have relied upon bonds to be a source of income and to help dampen overall portfolio volatility because of their lack of correlation to stocks. However, with interest rates low, inflation picking up, and the US Federal Reserve contemplating raising rates in the near future, many bond securities have lost value recently (see iShares exchange traded funds representing a variety of bond markets since September 20 below). As a result, investors may need to rethink the role that bonds play in their portfolios if we enter a prolonged rising rate environment.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$79.56 |

$48.52 |

| Gold |

$1,756 |

$1,893 |

| US Dollar |

94.10 |

89.94 |

| 2 Year Treasury |

0.32% |

0.13% |

| 10 Year Treasury |

1.61% |

0.93% |

| 30 Year Treasury |

2.16% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of October 9, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

12.4% |

16.3% |

| Global Equity |

MSCI All-Country World ESG Leaders |

13.7% |

16.0% |

| US Large Cap Equity |

S&P 500 |

18.2% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

15.2% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

13.9% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

7.8% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

-0.9% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

0.6% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-2.1% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-4.4% |

9.2% |

| Source: YCharts as of October 9, 2021 |

[1] Source: Sept. Jobs Report Misses: 194K Jobs Added, 500K Estimated - Bloomberg

[2] Source: YCharts

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.