Key Events: The Fed is serious about inflation

Key Events: The Fed is serious about inflation

The market seems to be grasping for any hope that the Fed will pivot towards a more accommodating path. After the stock market roared back from a dismal third quarter on Monday and Tuesday, a couple of calm days followed. However, the market’s hopes ran head-on into some good economic news on Friday. Yes, you read that right – good news is bad news right now, because it means the Fed will stick to its plans to raise interest rates.

The offending data was the jobs report, which showed a labor market that remains strong. One of the big drawbacks of the inflation fight is that the economy must slow, which means unemployment is likely to go up. This strong employment report gives the Fed license to remain on its tightening trajectory, contrary to market hopes.

Market Review: A volatile week

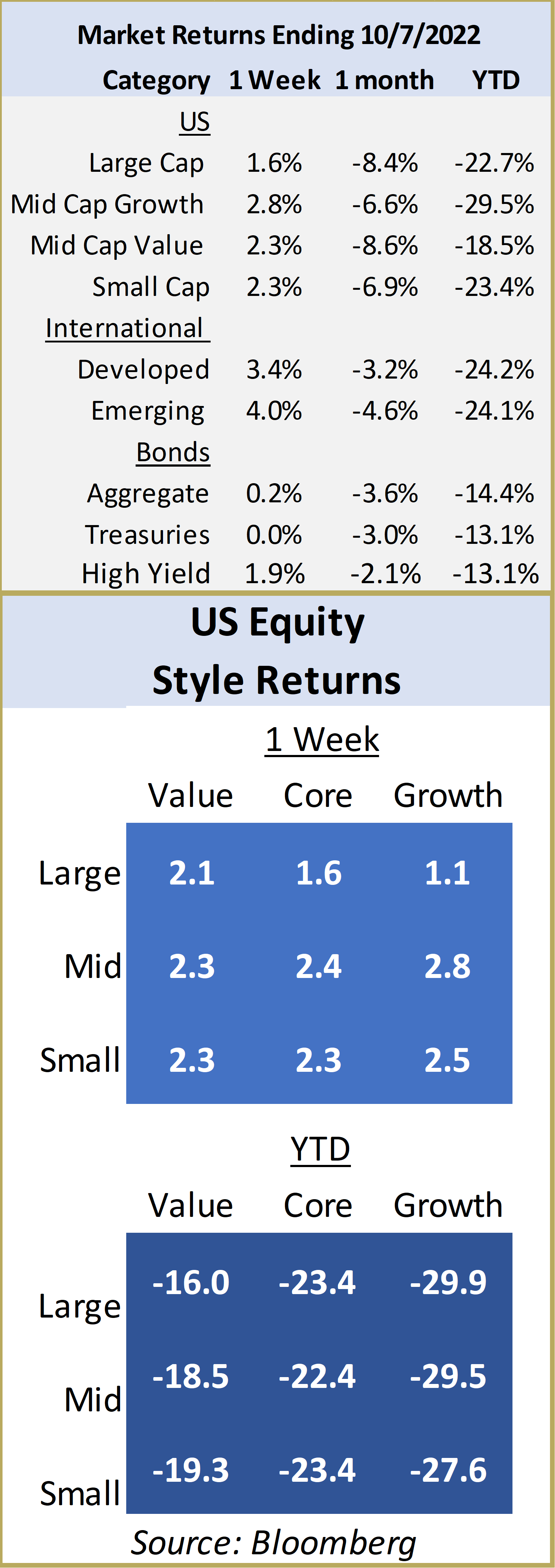

The stock market launched into the 4th quarter with a 4.7% gain on Monday and Tuesday. This was one of the best 1% of all two-day gains since January of 2000.[1] A couple of calm days followed, but we had more fireworks on Friday, as the “good therefore bad” jobs data cause stocks to sell off significantly. US large cap stocks gained 1.6% for the week, with small and international stocks performing better. Bonds gained as well, with the Bloomberg Aggregate bond index up 0.2% and high-yield bonds up 1.9%.

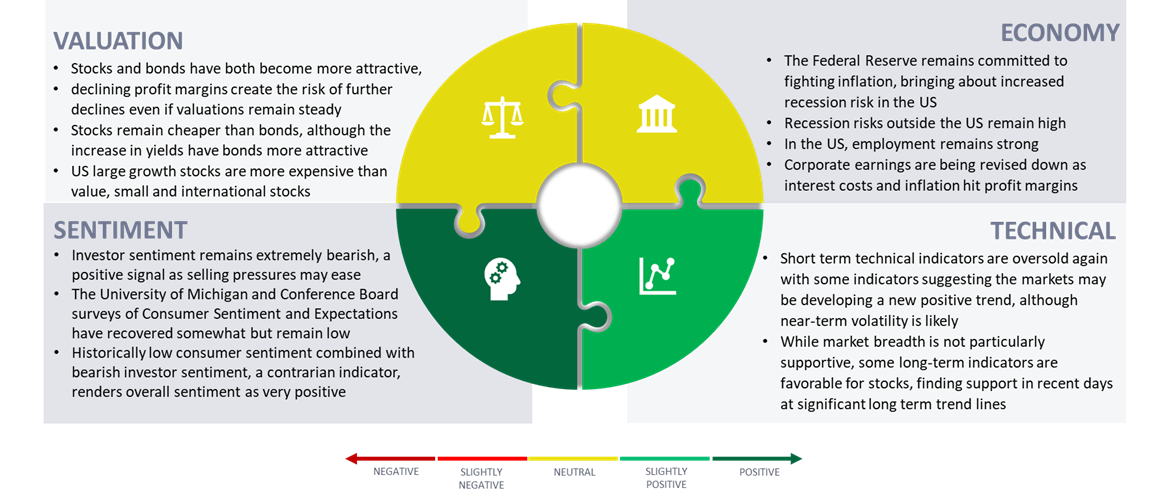

Outlook: Expect volatility to continue

We’ve been talking about this for a while, but don’t expect volatility to recede just yet. As can be seen in the graphic below, from Visual Capitalist, rates have risen faster than at any other time in recent history. Volatility is likely to remain while the Fed remains aggressive. Remember, though, that fantastic returns often follow difficult periods. The ten best months for stocks in the last 20 years include April 2020, the first month after the pandemic, and March and April 2009, the first two months after the Global Financial Crisis ended.

Navigator Outlook: October 2022

[1]Source: Bloomberg, OneAscent Investment Solutions

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.