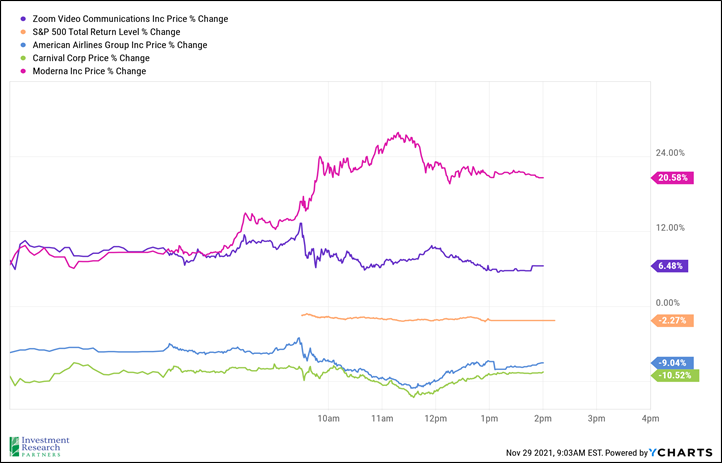

The Friday following Thanksgiving, typically a quiet day in equity markets, was anything but quiet this year as news of a significantly mutated COVID-19 variant discovered in South Africa led to a “sell first ask questions later” trading day. The S&P 500 index declined 2.3%, but many “reopening” stocks like airlines and cruise lines declined 10% or more. Conversely, “stay-at-home” companies like Zoom Video Communications (ZM) advanced more than 6% and vaccine-maker Moderna advanced more than 20%. The World Health Organization labeled the new strain as Omicron and gave it the designation of “variant of concern” given its potential for faster transmission and ability to reinfect those who have already had previous COVID strains.[1] Researchers at Pfizer and Moderna have already begun studying the variant in an effort to adapt their vaccines accordingly. Both firms have indicated that they anticipate being able to ship new vaccines within 100 days.[2]

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$68.04 |

$48.52 |

| Gold |

$1,784 |

$1,893 |

| US Dollar |

96.02 |

89.94 |

| 2 Year Treasury |

0.50% |

0.13% |

| 10 Year Treasury |

1.48% |

0.93% |

| 30 Year Treasury |

1.83% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of November 26, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

15.1% |

16.3% |

| Global Equity |

MSCI All-Country World ESG Leaders |

17.1% |

16.0% |

| US Large Cap Equity |

S&P 500 |

23.9% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

18.7% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

14.7% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

7.4% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

-3.5% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

0.5% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-1.5% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-4.6% |

9.2% |

| Source: YCharts as of November 26, 2021 |

[1] https://www.who.int/news/item/26-11-2021-classification-of-omicron-(b.1.1.529)-sars-cov-2-variant-of-concern

[2] https://www.nytimes.com/2021/11/28/health/covid-omicron-vaccines-immunity.html

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.