Key Events: Surveying Stability

Fiscal sustainability emerged as the primary risk In the Fed’s semi-annual financial stability report. Inflation has faded away as a risk to stability.

Geopolitical instability remains a significant concern following the US decision to provide Ukraine with access to longer-range missiles, prompting strong reactions from Moscow.

Market Review: Santa Claus is coming to town

The “Santa Claus” rally may have begun early this year, as most US markets performed well this week.

International stocks were subdued, while bonds performed well after two months of losses.

Outlook: Maintaining discipline

It’s important to acknowledge that our “Santa Claus rally” thesis is largely speculative. There is quite a limited level of certainty about what influences the market on any given day or week. We strive to maintain discipline and build portfolios aimed at long-term stability, but current government spending policies are antithetical to that goal.

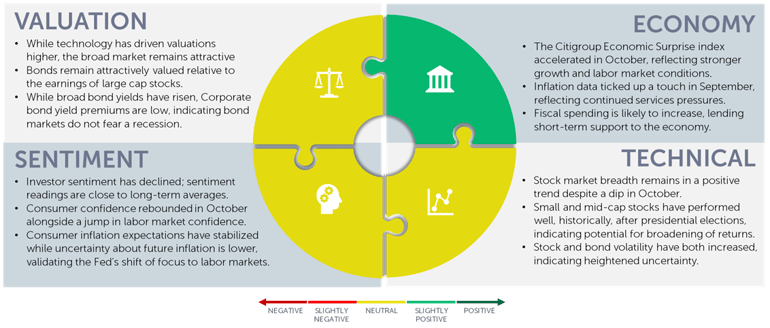

In the coming weeks and months, we will delve deeper into these issues. For now, we are taking two concrete actions: First, while stocks are not particularly cheap, we are allocating funds towards attractive opportunities outside the current leaders. Second, while corporate bond yields are narrow and offer limited long-term value, we are seeing rising yields across various sectors, such as mortgages, which present compelling investment opportunities.

We wish you a joyful and prosperous season of gratitude and celebration!

Navigator Outlook: November 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01049