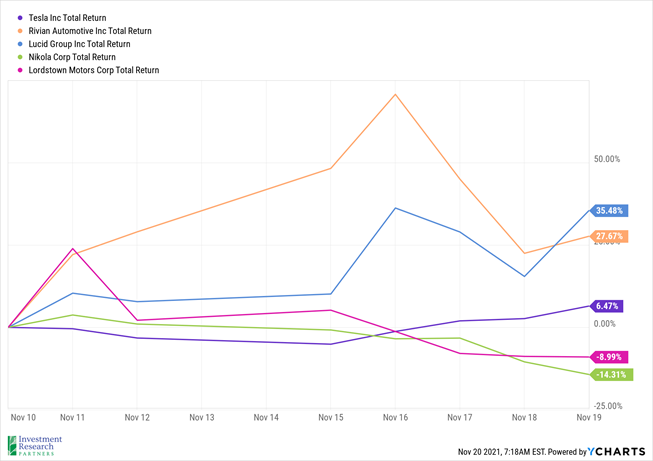

Electric vehicles, also referred to as “EVs”, are getting renewed interest from both consumers and investors after Rivian stock skyrocketed after going public with the sixth largest initial public offering in US history (see chart below).[1] The EV market, which has been dominated by Tesla for the past decade, is getting more crowded by the day as newer companies such as Rivian, Lucid, Lordstown, and Nikola join larger established automotive companies like Ford, General Motors, and Toyota in launching new options. Improved battery technology, extended range, lower maintenance costs, and more competitive sticker prices have all been touted as reasons that EVs will continue to gain in market share in the years to come.

Equity markets were relatively flat last week, as the MSCI ACWI (a proxy for large-cap global stocks) ended 0.2% below the previous week’s close[2] Large US stocks fared better than non-US peers, as a resurgence of Covid-19 in Europe is straining health systems. Austria will enter a lockdown period beginning on Monday and investors are worried that more lockdowns and restrictions in the region will slow economic output.[3]

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$75.68 |

$48.52 |

| Gold |

$1,847 |

$1,893 |

| US Dollar |

96.07 |

89.94 |

| 2 Year Treasury |

0.52% |

0.13% |

| 10 Year Treasury |

1.54% |

0.93% |

| 30 Year Treasury |

1.91% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of November 20, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

18.4% |

16.3% |

| Global Equity |

MSCI All-Country World ESG Leaders |

21.0% |

16.0% |

| US Large Cap Equity |

S&P 500 |

26.7% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

18.2% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

19.6% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

11.6% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

0.1% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

1.1% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-1.6% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-4.5% |

9.2% |

| Source: YCharts as of November 20, 2021 |

[1] Source: Rivian Pursues Standalone Battery Plant, Expansion Projects After IPO - Bloomberg

[2] Source: YCharts

[3] Source: Covid Surge: Europe Resorts to Lockdowns Once More - Bloomberg

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.