Key Events: Fed officials reaffirm inflation focus despite moderating inflation data

Key Events: Fed officials reaffirm inflation focus despite moderating inflation data

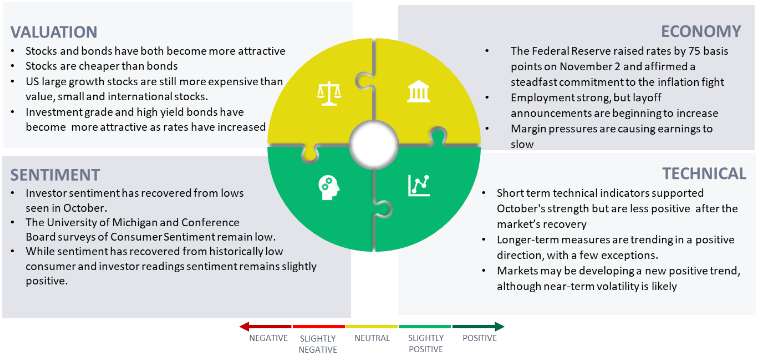

This week several Fed officials expressed that rates could continue to rise. St. Louis Fed president James Bullard, for instance, indicated the peak of Fed Funds might be in the 5%-7% range, significantly higher than the current 3.75%. They delivered this message despite (or perhaps because of) the milder than expected inflation data released on Tuesday.

Meanwhile, the mid-term elections resolved this week; control of the house will rest with Republicans, while the Democrats will control the Senate—a ‘market-friendly’ outcome.

Market Review: ‘Friendly’ data runs into an ‘unfriendly’ set of Fed speakers

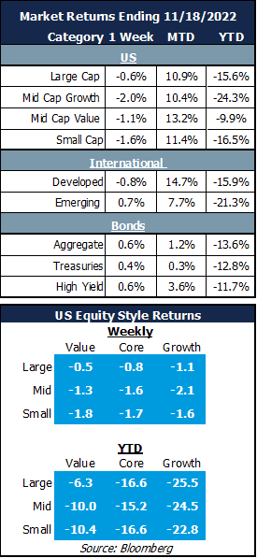

Fed speakers’ pessimism overcame the slightly lower, market-friendly, Producer Price Index data released on Tuesday, causing stocks to drift lower throughout the week as the odds of a Fed-induced recession increased. The S&P 500 finished the week down 0.6%, while bonds gained slightly across the board.

Outlook:

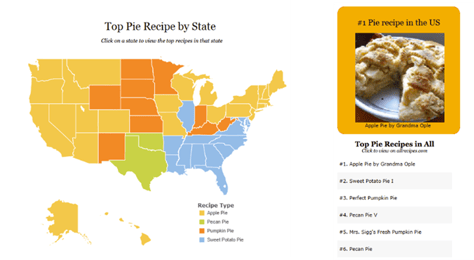

This week we focus on what we are thankful for, and while doing so many of us (including this author!) will enjoy too much food. Despite persistently high food prices—the average price of a Thanksgiving pie is up 18.6% from a year ago—we can choose to focus on the positive (maybe name a couple positives in the market?). Below is a chart of America’s favorite pies. We wish you a blessed season of giving thanks![1]

Navigator Outlook: November 2022

[1]Source: Rivery Thanksgiving Data: 7 Fun Data Visualization Graphs (rivery.io)

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00080