Key Events: Real Progress

President Biden said “real progress” was made in a summit with China. Tensions resurfaced after the event, though, as a Chinese spokeswoman indicated Tawan reunification was “unstoppable” and Biden labeled Xi a dictator.

US inflation slowed significantly in October, lending credence to the market’s view that the Federal Reserve may be finished with rate hikes.

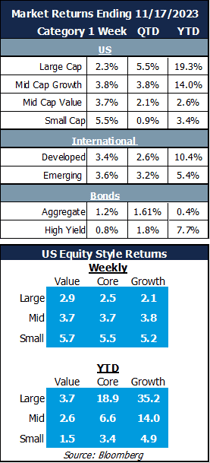

Market Review: Soft landing hopes drive stocks higher

Stocks continued November’s surge on hopes of a soft landing, a viewpoint held by the Fed: The S&P 500 rose 2.3% while more economically sensitive small cap stocks rose by 5.5%, bringing them to a positive return for the year.

Bonds gained after tame inflation data renewed speculation that rates have peaked.

Outlook: The soft landing we’ve been hoping for?

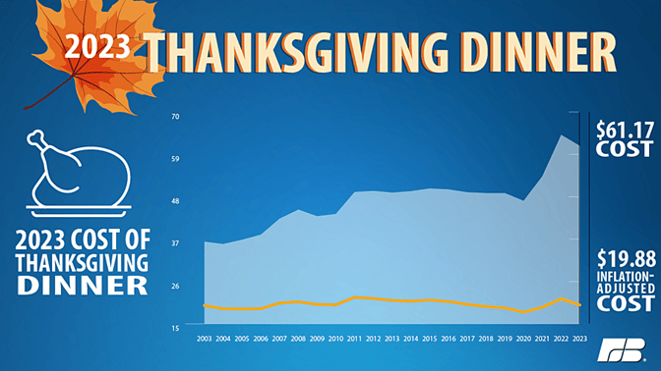

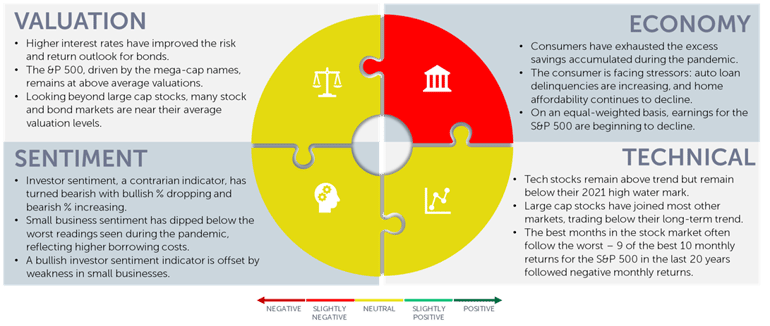

A soft landing – lower inflation without recession – is the market’s hope. Inflation has continued its decline (see the thanksgiving chart below) and economic data shows a cooling, but strong, economy. Concerns include high interest rates and lower bank lending.

A soft landing would also be associated with a resumption of profit growth, which we saw in the third quarter. Shrinking corporate bond spreads reflect optimism as well – the bond market is not worried about a recession.

While it may materialize, we are not banking on a soft landing. OneAscent portfolios remain diversified, with less exposure to the mega-cap names that have driven the S&P 500 this year. We maintain exposure to several overlooked areas of the market which have experienced modest recent returns, but which have a high margin of safety and the potential for solid long-term returns.

Thanksgiving dinner costs drop[1]

Navigator Outlook: November 2023

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: American Farm Bureau Federation Thanksgiving Dinner Cost Relief, But Still High Relative to Recent Years | Market Intel | American Farm Bureau Federation (fb.org)

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggretate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00539