Key Events: Trump administration takes shape

Trump began to shape his administration with some surprising appointments which appear set to endure uphill confirmation battles.

Republicans solidified their hold on the House and will control, fully, Congress and the Presidency.

Market Review: Sell the news

Stock markets reacted negatively this week to some combination of 1) “sell the news” of a Trump victory 2) the prospect of full Republican control (historically a negative for markets) 3) heartburn over Trump’s early personnel choices.

Stocks and bonds sold off together, with the worst losses in small caps and emerging markets.

Outlook: Maintaining discipline

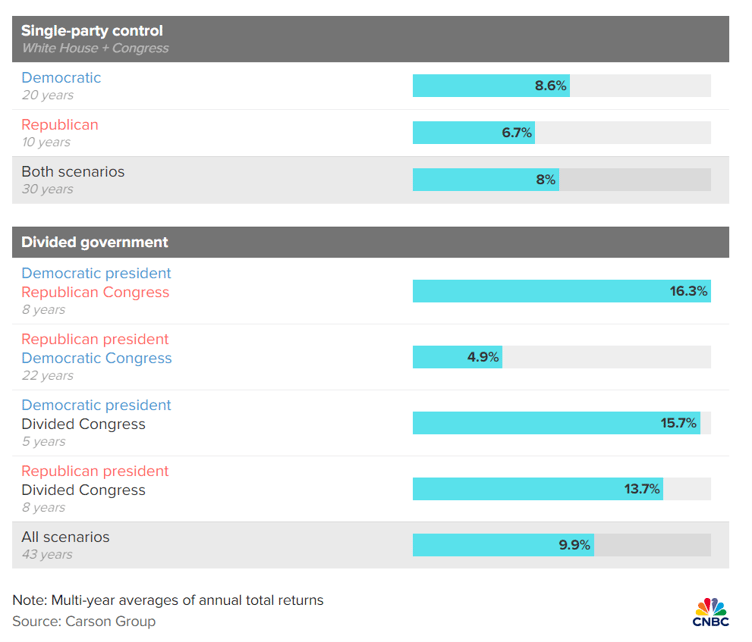

Markets experienced some volatility in the wake of Trump’s victory; we point out that control of the House, Senate and Presidency is one of the less attractive scenarios since 1951 which, along with the above points, may explain the pullback in stocks.

Trump’s appointments have sowed doubts about his administration, and some of them seem doomed from the start. While this is not an auspicious lead-in to his Presidency, we, as normal, urge investors to remain focused. Even with the House and Senate under Republican control, don’t expect the full range of Trump’s policy desires to come to fruition.

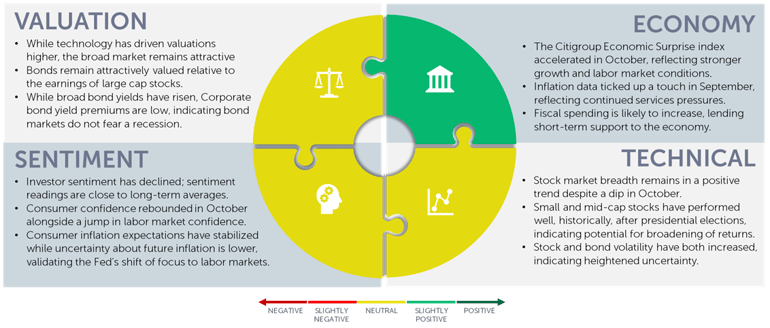

The markets will still function, and the economy certainly appears to be on strong footing. We counsel investors to stay invested, stay disciplined and stay diversified.

Stocks favor divided government[1]

Navigator Outlook: November 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: CNBC CHART: A divided U.S. government is historically better for stocks

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01047