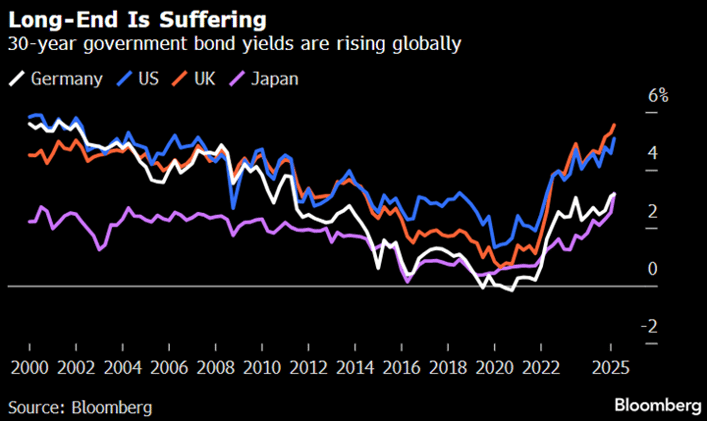

Key Events: Long-term bond yields rose above 5%

In the week following Moody’s downgrade of US Government debt, the thirty-year bond yield reached a peak of 5.15% in the US (highest level since 2007)[1].

The rise in yields has not been confined to the US. It is a global phenomenon that reflects expansionary fiscal policy. The implications of higher rates include lower growth expectations and a higher equity risk premium (an increase in the margin of safety for investors).

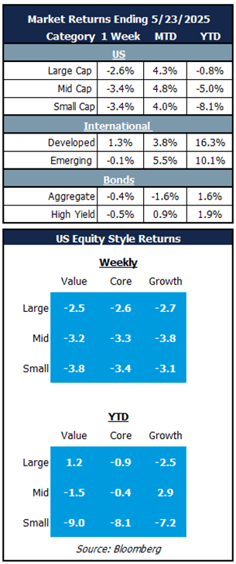

Market Review: Global rebalancing continues

US equities pulled back this week as the news of last week’s downgrade and the potential long-term impacts to debt and deficits implied by the ”big, beautiful bill” were digested by financial markets. The Bloomberg Dollar Index fell by more than 1.5% last week and International Developed Markets delivered a positive return.

Outlook: “Not unmindful of the future”[2]

Memorial Day weekend is accompanied by a wave of graduations, and I often find myself reflecting upon my alma mater’s motto this time of year: “Non in cautus futuri.[3] (translation: “not unmindful of the future”.) Perhaps we should consider the idea that the bond market is doing its very best to be quite mindful of the future by raising rates under the current circumstances: high debt levels and large deficits.

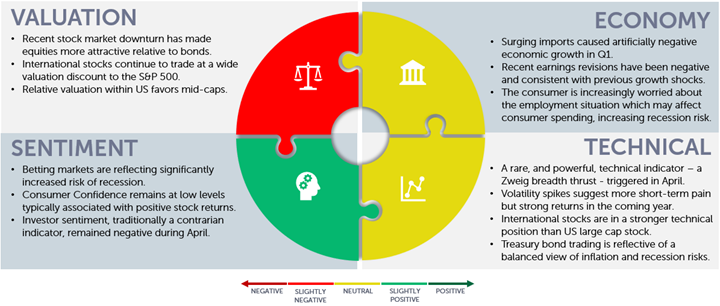

The consequences of a sustained period of higher rates would include lower valuations for risk assets. The warning from the bond market indicates that financial markets are functioning well by sending a signal to legislators world-wide that unchecked spending could lead to undesirable outcomes. This is all part of the process of finding the best way forward and managing these risks is paramount in our efforts to compound portfolios continuously over time.

Long-term Yields Rising across the Globe

Navigator Outlook: May 2025

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg article on May 2, 2025, “Long-term Bond Yields Soar Globally on Fiscal Policy Fears”.

[2] Source: Translation for the Washington & Lee University motto “Non in cautus futuri.”

[3] Source: “Non in cautus futuri” is the Washington & Lee University motto.

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01256