Key Events: When meme stocks take a roller coaster ride

Money flow drove meme stock mania; GameStop soared 271% early in the week, only to decline significantly through Friday, finishing the week up only 27% after announcing a massive offering of company stock.

Inflation data showed only a modest gain, raising confidence in the Fed’s ability to lower inflation.

Market Review: When stocks walk the inflation tightrope

Lower inflation increases the odds of quicker rate cuts, creating liquidity in the system. Hopes for lower rates drove stocks higher, with interest sensitive REITs joining technology as top performers for the week.

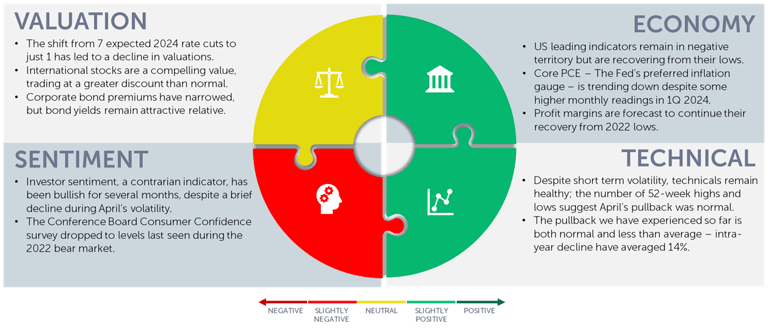

Outlook: When the market rides a wave of liquidity

In recent months liquidity and momentum have driven price action of GameStop and AMC, two of the poster-child meme stocks. We know that hype is driving these movements, but we also know that liquidity and momentum are driving the economy and stock market:

The Fed is supporting the system through bank lending programs and the slowing of Quantitative Tightening.

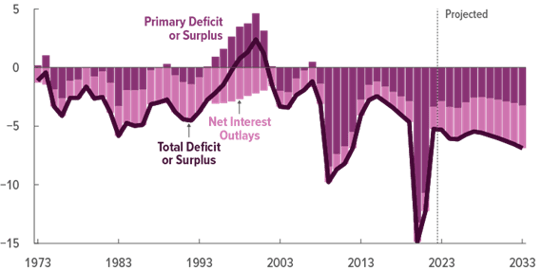

The government is running a $1.7 Trillion fiscal deficit – a level historically experienced only during a recession.[1]

This stimulus has supported the economy, stock, and bond markets, perhaps artificially. More importantly, stimulus can’t go on forever. Eventually, fundamentals must drive the economy and the investment markets.

Our long-term discipline seeks out managers who invest in solid companies with strong fundamentals, staying off the volatile rollercoaster of the latest fad. We build portfolios for the long-term, and we encourage investors to avoid short-term speculation.

When liquidity drives meme stocks and the market [2]

US Fiscal Deficit

Navigator Outlook: May 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Congressional Budget Office The Budget and Economic Outlook: 2023 to 2033 | Congressional Budget Office (cbo.gov)

[2] Source: Microsoft Copilot https://copilot.microsoft.comh This week’s headlines and chart are generated by Microsoft Copilot AI generator and are designed to illustrate that meme stocks are being driven by liquidity in the market, but so is the market as a whole.

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00802