Key Events: Economic Goldilocks, but waning confidence

Key Events: Economic Goldilocks, but waning confidence

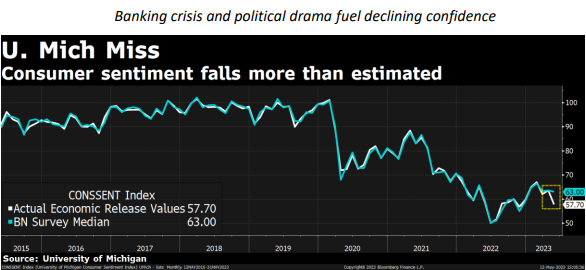

Reported inflation was not too hot or too cold, furthering market hopes for a pause in rate hikes. Consumer sentiment, however, declined more than expected (see chart below).

Political headlines may account for some of the drop:

- McCarthy and Biden made no progress on the debt ceiling.

- Trump was found liable for sexual abuse, and Rep. George Santos was arrested on financial-related charges.

Market Review: Churning to nowhere

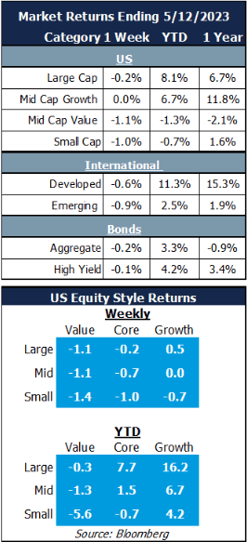

Stocks declined slightly this week as economic confidence waned; growth stocks’ modest gains were the exception.

Bonds registered small gains as market expectations for 2023 Fed rate cuts increased.

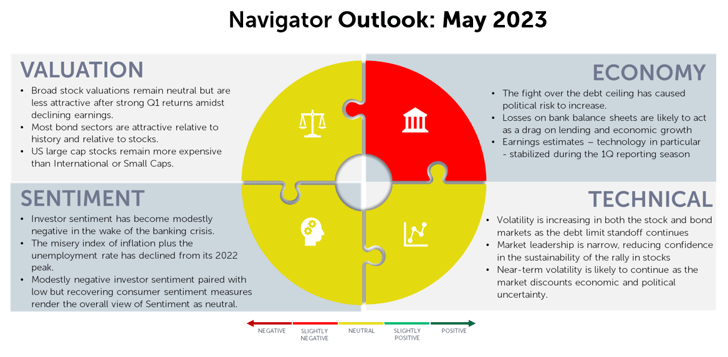

Outlook: Expectations become reality

Consumer confidence declined more than expected, likely due to the continued banking crisis and political tensions.

This drop in confidence reminds us of the importance of expectations in our economy. Worsening expectations increase the likelihood of slower economic growth and continued volatility in the investment markets.

While the political drama plays out and the banking crisis continues to unfold, OneAscent continues to follow our disciplined process. Portfolios remain diversified, with flexibility to take advantage of opportunities the market may present.

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00288