Key Events: One Trade Pact, More to Come

President Trump announced a trade agreement with the UK, the “first of his promised deals with countries around the world”.[1]

As expected, the Federal Reserve held interest rates steady as “the costs of waiting to see further are fairly low” according to Fed Chair Powell.[2]

Market Review: Stocks marked time on the week

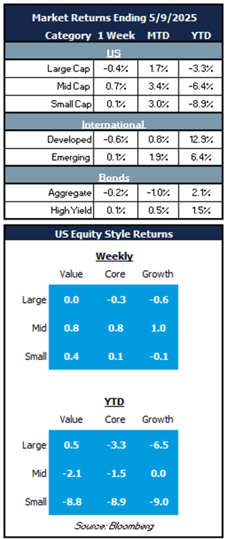

After several weeks of abnormal volatility, global equities were mixed and subdued. Mid-cap stocks were the best performers but were up less than 1%. International took a breather.

The aggregate bond index backtracked modestly as the 10-year yield moved 7 basis points higher for the week.[3] High yield improved on lower spread risk.

Outlook: Continued trade progress required

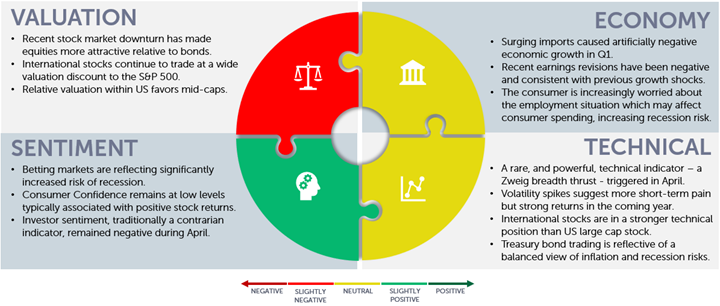

The S&P 500 has recovered to levels that were in place before the “Liberation Day” tariff announcement as risks have receded and the anticipation of trade deals have provided some optimism. In the near term, the direction of US-China trade negotiations holds great significance for the performance of global equities. Any significant setbacks could reignite the volatility flames that have faded to embers.

For its part, the Fed appears to be in a wait-and-see mode until unemployment worsens, or they gain confidence that the inflation outlook is more benign. Patience may be necessary as the market may have to wait longer than it would like before the next rate cut.

The consolidation in equity markets this week suggests that a pause in momentum may be in place until more clarity emerges. Growth expectations have been lowered and Fed Governor Barr warned that he expects “tariffs to lead to higher inflation in the United States and lower growth in the United States and abroad starting later this year."[4]

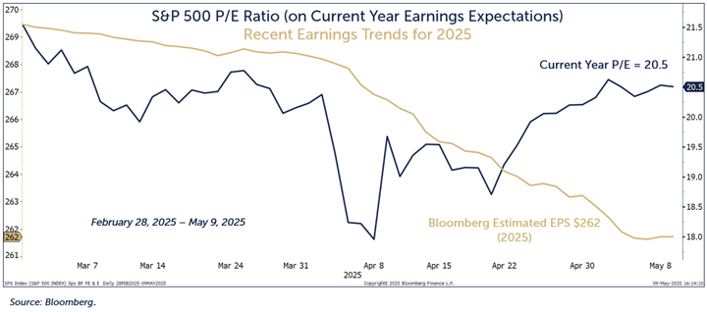

Since the end of the first quarter, S&P 500 earnings estimates declined more than 2% and the 2025 P/E ratio has fully recovered post the tariff downdraft.

Navigator Outlook: May 2025

Download PDF Version

This material is intended to be educational in nature,[5] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg article on May 8, 2025, “Trump Hails ‘Full’ US-UK Trade Pact in First Post Tariffs Deal”.

[2] Source: Wall Street Journal story by Nick Timiraos “Why the Fed Isn’t Ready to Join Other Central Banks in Cutting Rates” via Bloomberg.

[3] Source: Bloomberg data.

[4] Source: Bloomberg story, “Fed’s Barr Warns Tariffs Risk Higher Inflation, Unemployment”.

[5] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01248