Key Events: Liberation from low prices

President Trump's announcement of new “liberation day” tariffs on auto imports sparked market disruption and concerns of rising inflation.

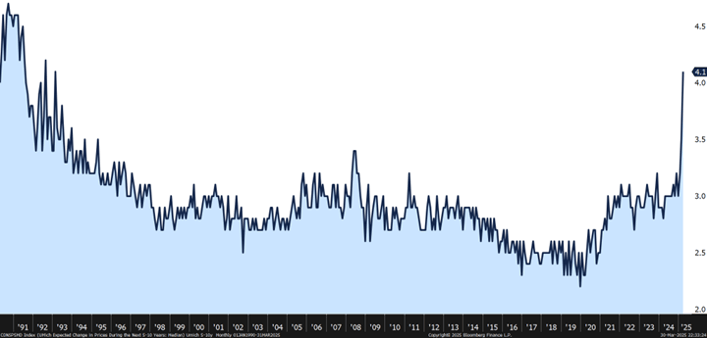

Inflationary pressures showed up in data releases, while long-term inflation expectations rose to multi-decade highs, as shown in the chart below.[1]

Market Review: Tariff uncertainty hits stocks

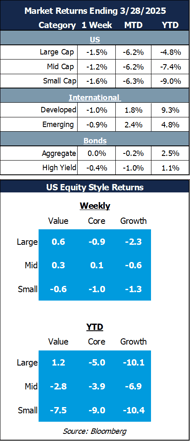

US stocks sold off as worries over inflation, tariffs and slower growth took hold, continuing the trend of US losses and international gains in a stark reversal from prior years.

The broad bond market was flat as inflation and slower growth fought to a stalemate. Gold hit new highs as uncertainty increased safe-haven demand.

Outlook: What we can – and can’t - predict

There is much we cannot predict; what President Trump will do is at the top of the list – regardless of your political bent. We also can’t predict short-term market moves, driven by emotion, technicals, corporate earnings and geopolitics.

What can we predict? One thing we can be certain of is that we won’t be successful if we don’t have a process in place to tame our emotions.

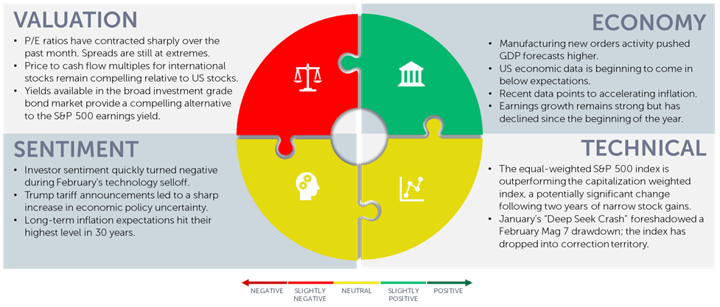

The Navigator puzzle pieces below show that our process was neutral, with some positives and some negatives, coming into the month. There has been a slight worsening in the economy, as growth appears to be slowing, and inflation is rearing its ugly head. Sentiment has gotten remarkably bearish, something our process views as a positive sign.

We remain fully invested in a diversified portfolio of stocks and bonds, with the flexibility to react to market opportunities. We encourage investors to stick to their plan.

Long-Term Inflation Expectations Spike as Tariffs Create Uncertainty

Navigator Outlook: March 2025

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bureau of Economic Analysis showed an increase in Core PCE. University of Michigan survey showed 5-10 year expectations ag 4.1%, the highest level since the 1990s.

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01182