Risk assets, in general, advanced last week, building upon a big bounce upward the week prior. The S&P 500, a proxy for US large-cap stocks, gained 1.8 percent for the week and the MSCI ACWI, a proxy for global large-cap stocks, advanced 1.2 percent.

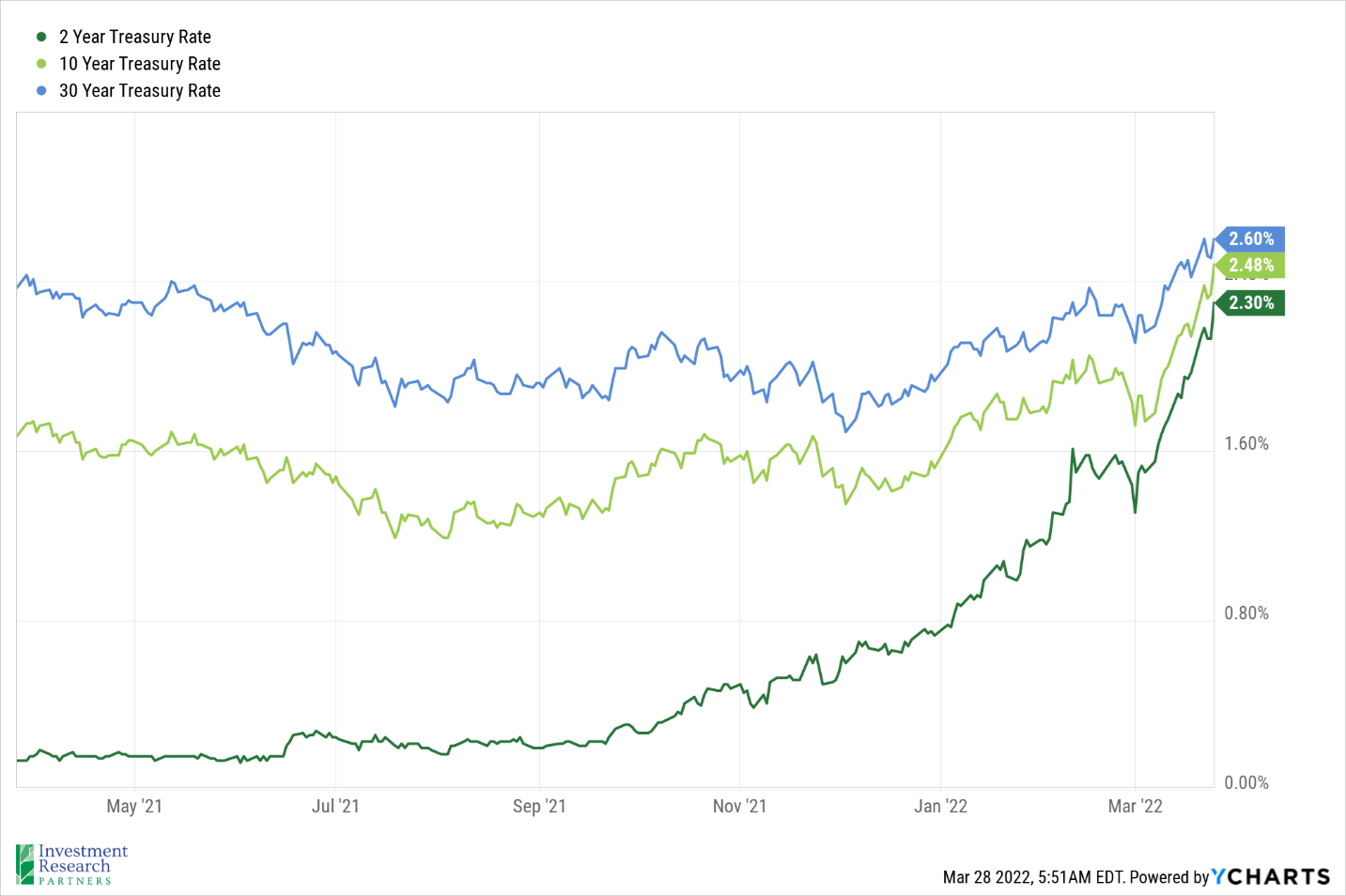

While the rebound in equities the past few weeks brings some relief to stock investors, bond markets continue fall in the face of surging inflation and rising interest rates. US Treasury rates have spiked recently, with the two-year increasing from 0.73 percent at the beginning of the year to 2.30 percent today (dark green line below). With only a few days before quarter-end, Treasuries are currently on track for one of their worst quarters since the 1970s.[1]

As the conflict in Ukraine passed the one-month mark, there appears to be little progress in peace talks thus far. However, a shift in Russian messaging over the past week may provide at least some reason for optimism. Russia has begun to describe the primary focus of the invasion as “the complete liberation of Donbas” rather than the demilitarization of the country as they stated at the onset of the invasion. The walk back in rhetoric may provide Putin with the opportunity to end the violence but still claim victory at home.[2]

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2021 |

| Crude Oil (US WTI) |

$109.67 |

$75.37 |

| Gold |

$1,926 |

$1,828 |

| US Dollar |

98.81 |

95.67 |

| 2 Year Treasury |

2.30% |

0.73% |

| 10 Year Treasury |

2.48% |

1.52% |

| 30 Year Treasury |

2.60% |

1.93% |

| Source: Morningstar, YCharts, and US Treasury as of March 28, 2022 |

Asset Class Returns

| Category |

Representative Index |

YTD 2022 |

Full Year 2021 |

| Global Equity |

MSCI All-Country World |

-5.7% |

18.5% |

| Global Equity |

MSCI All-Country World ESG Leaders |

-6.9% |

20.8% |

| US Large Cap Equity |

S&P 500 |

-4.4% |

28.7% |

| US Large Cap Equity |

Dow Jones Industrial Average |

-3.6% |

21.0% |

| US Small Cap Equity |

Russell 2000 |

-7.2% |

14.8% |

| Foreign Developed Equity |

MSCI EAFE |

-7.1% |

11.3% |

| Emerging Market Equity |

MSCI Emerging Markets |

-8.4% |

-2.5% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

-6.2% |

1.5% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-6.9% |

-1.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-7.1% |

-4.7% |

| Source: YCharts as of March 28, 2022 |

[1] Source: Stock Market Today: Dow, S&P Live Updates for Mar. 25, 2022 - Bloomberg

[2] Source: Russia Says 'Main' Focus of Ukraine Operation Is on Donbas: Interfax - Bloomberg

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.