Key Events: We’re from the government, and we’re here to help

Key Events: We’re from the government, and we’re here to help

It wasn’t a great week for government communications:

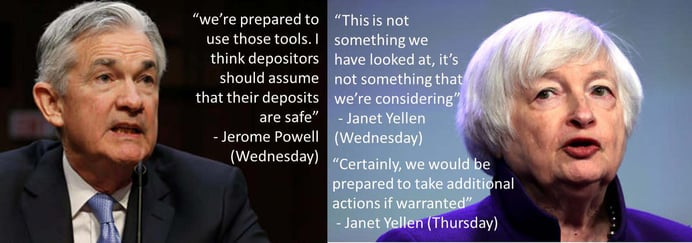

- While The Federal Reserve Raised rates 0.25%, chairman Powell assured us that bank deposits were safe.

- Secretary Yellen was less enthusiastic. (see chart below)

- Chinese-owned TikTok attempted to reassure congress that the CCP was not accessing US user’s data.

- Chancellor Scholz reiterated that Deutsch bank, and the European banking system, were sound after shares tumbled.

- Fed Chair Powell was somewhat clearer in signaling one more rate hike this year, as the banking crisis and credit crunch are likely to reduce future inflation and increase odds of a recession.

Market Review: Looking forward

While it is easy to make fun of Mr. Powell and Ms. Yellen’s communication foibles, the market sorted it out.

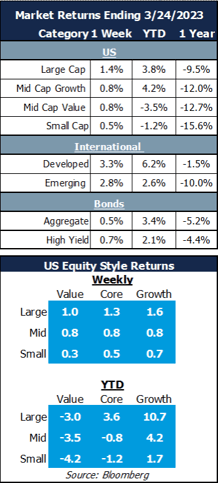

The S&P 500 gained 1.4% for the week while smaller-cap stocks and bonds finished with slight gains.

International stocks were the winner for the week: Developed stocks were up 3.3% and emerging markets up 2.8%.

Outlook: “Long and Variable Lag”

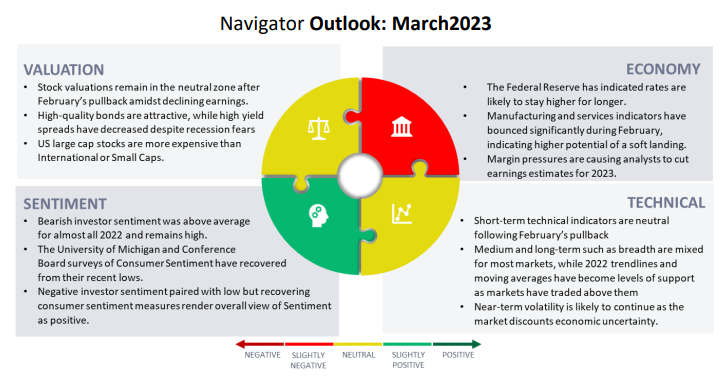

Monetary policy is a fairly blunt tool, described as having a long and variable lag before it takes effect; it’s an imperfect science. Here’s what’s important for the markets after this Fed Meeting:

- It’s not very easy to say exactly how much of the Fed’s work is being done – by how much inflation will come down due to the banking crisis. It is very easy to be wrong.

- The Fed wants to make a decision that would be easier to fix – if it were to go wrong – and won’t have huge negative consequences.

- That means raising rates higher, keeping them there longer, and lowering them more slowly.

However, none of this would be possible if the banking system was not stable. It is stable.

Additionally, the US Government has shown a willingness to take the steps needed to protect the banking system, and there is no reason to expect that would change, There are legitimate things to be worried about, and we account for that in our portfolios. The market may climb this wall of worry – as it often does – rewarding investors who stay the course.

We’re from the Government, we’re here to help

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00213