Weekly Investment Update March 24, 2025

March 24, 2025 •Peter Klingelhofer

Key Events: Fed holds steady amidst uncertainty

The Federal Reserve held interest rates steady this past Wednesday and candidly admitted that “uncertainty around the economic outlook has increased”[1]. Even though the Fed indicated that uncertainty related to tariffs may be leading to higher inflation expectations and lower growth[2], the market appeared to be comforted by the potential for lower interest rates and the Fed’s capacity to respond in this environment.

The stock market’s role as a discounting mechanism has been evident in the recent pullback, reflecting concerns about a modest growth scare. Further stabilization from this point should support confidence in the prospect for recovery.

Market Review: S&P 500 advances for first time in 5 weeks

US stocks closed the week on a positive note last Friday enabling the first weekly advance for US equities since mid-February. International stocks continued to march forward even though the dollar moved slightly higher on the week.

The broad bond market showed incremental gains as interest rates fell on the week due to somewhat accommodative comments from Fed Chairman Jay Powell.

Outlook: A modest “rolling recovery”[3]

Last week we shared a historical chart”[4] comparing intra-year declines and calendar year returns that showed the average intra-year decline since 1980 is 14.1%, so there is nothing magical about a 10% pullback to stimulate buying interest.

However, opportunistic investors should take a broad review of the outlook to gauge the appropriateness for increasing risk. After all, a simple return to the highs over one year would produce a total return of more than 10% including dividends. This is where a ‘margin of safety’ comes into play.

One way to gauge the concept of a ‘margin of safety’ is by analyzing the price you pay by comparing today’s forward P/E ratio with longer-term averages and the levels of previous low points (see the chart below).

The forward P/E ratio for the S&P 500 currently stands at 20.5 times blended forward estimates. That compares to a long-term average over the last 30 years of 17 and an average of the last 5 significant low points of 15.9. While the current pullback in equities may offer a “rolling recovery” for stocks and sectors that are down substantially more than the market, the elevated P/E ratio for the market overall does not offer enough ‘margin of safety’ to induce a robust increase in risk appetite. There may be room for a tactical increase in risk in a specific asset class, but not a meaningful change to strategic allocation.

We remain largely neutral equities with a strategic allocation favoring value, small and mid-caps and international equities with a preference for strong free cash flow yield and quality dividend growth.

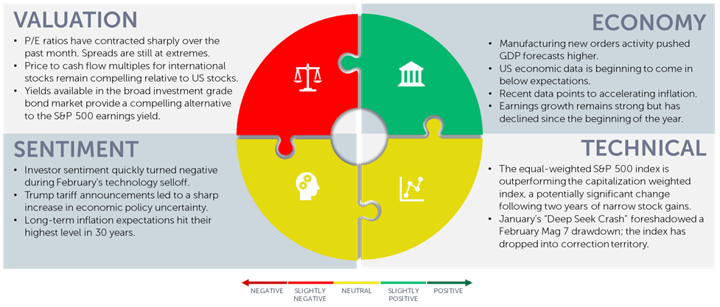

Navigator Outlook: March 2025

This material is intended to be educational in nature,[5] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg column by John Authers, “The Fed is Clueless, Too. And That’s OK.”

[2] Source: Bloomberg column by John Authers, “The Fed is Clueless, Too. And That’s OK.”

[3] Source: Bloomberg column “Mike Wilson Sees No More New Highs for Stocks in the First Half” in which he mentions the idea of a “rolling recovery” for equities.

[4] Source: JPMorgan, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2024, over which time period the average annual return was 10.6%. Guide to the Markets – U.S. Data are as of March 12, 2025. (Chart from last week’s weekly update.)

[5] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01180