Key Events: Tariffs intensify economic uncertainty

Trump imposed a 25% tariff on steel and aluminum imports and warned of a 200% tariff on European alcohol in response to proposed whiskey tariffs.

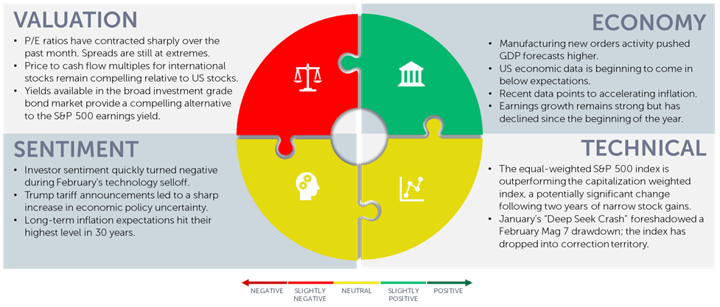

Increased trade tensions have reduced growth forecasts and caused inflation expectations to explode to their highest levels in years[1].

Market Review: S&P 500 dips into correction

US stocks recovered on Friday after the S&P 500 dipped into correction territory - a 10% drop from their February highs - and small caps came within whisker of a 20% bear market decline. International stocks are ahead of US markets by more than 10% in 2025 as a decline in the dollar and improved earnings have driven them to strong returns.

The broad bond market held steady while recession fears drove losses in high yield bonds.

Outlook: Rudyard Kipling’s trading plan

“If you can keep your head when all about you are losing theirs…you’ll be a man, my son!”[2]

Markets have dropped 10% in less than a month since mid-February’s high. This drawdown has reflected real, and important, concerns: Tariff uncertainty, unlike any in recent memory, has led to worries of accelerating inflation and a growth scare.

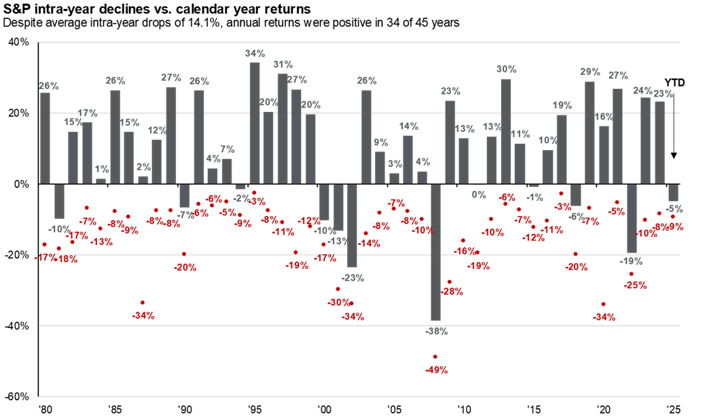

These are short-term concerns; our portfolios are built for the long term. We have experienced a smaller than average drawdown in the stock market (see the chart below). It might get worse; we don’t know. But we maintain a diversified portfolio – just like we did when the market was driven by momentum in a narrow segment of tech stocks.

Keep your head about you. Maintain diversification. Add to your portfolio during times, like this, when the market drops.

A visual to help us keep our heads about us, and maintain perspective[3]

Navigator Outlook: March 2025

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: University of Michigan. Long-term inflation expectations increased to 3.9%, their highest level since 1991, while 1-year expectations increased higher than expected to 4.9%, above expectations.

[2] Source: If, by Rudyard Kipling (1910), rewards and fairies.

[3] Source: JPMorgan, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2024, over which time period the average annual return was 10.6%. Guide to the Markets – U.S. Data are as of March 12, 2025.

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01179