Weekly Investment Update March 10, 2025

March 10, 2025 •Peter Klingelhofer

Key Events: Germany invokes “Whatever It Takes” [1]

Chancellor-in-waiting Friedrich Merz declared Germany would do “whatever it takes” to defend itself and pledged to ease constraints on government spending last Wednesday[2]. Local investors hailed the remarks as a landmark moment for Europe’s largest economy and the German market soared 3.4% in its biggest one-day rally since 2022[3].

Germany has historically retained staunch advocacy for tight budgets. A new plan to increase spending across defense and infrastructure represents a seismic shift that could lead to a "rewriting of the European investment playbook"[4].

Market Review: Foreign stocks surge; Domestic shares retreat

Domestic equities continued to backtrack during the week on fears of weaker growth due to prospects of an extended trade war and uncertainty around ever changing tariff announcements[5]. International stocks surged on the news of a gigantic change in mindset on the fiscal front in Germany. Currency markets interpreted the news with vigor as the Euro strengthened by 4.4% for the week[6].

Bonds sold off modestly as yields closed the week slightly higher. The 10-year yield rose 9 basis points to 4.3%[7].

Outlook: A ‘growth scare’ versus a ‘growth flare’

The retrenchment in US equity markets since mid-February has largely reflected investor fears regarding a weakening growth outlook. Lingering tariff anxiety and softening economic data have been the primary culprits to the current ‘growth scare’ in the US.

Conversely, Europe received a major jolt with the prospect of significantly reduced fiscal constraints in Germany. Friedrich Merz ‘growth flare’ set the stage for some impressive fireworks across markets. The immediate consequences of the momentous announcement last week are depicted in the following chart, which shows the recent strength of international markets and the corresponding weakness of the US Dollar[8]. It should be noted that the ECB followed through with a rate cut last week as well.

The developments that have led to the sea change on the fiscal front in Germany should be considered long-term positives for the US. President Trump has expressed a view that the US has carried too much of the burden on global defense over the past several decades and it should be very helpful for future US budgetary purposes if European countries share more of the responsibility for global peace and security by developing stronger internal defense capabilities. We welcome this new approach and believe it will contribute to the broadening of returns for multi-asset portfolios going forward. We maintain a modest overweight position in International equities in core strategies and have recently enhanced exposure through our Navigator process.

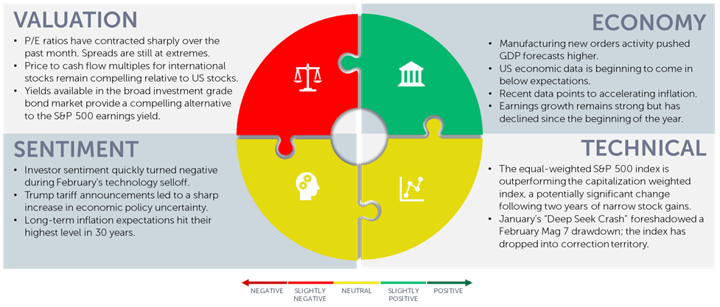

Navigator Outlook: March 2025

This material is intended to be educational in nature,[9] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg story “Germany’s ‘Whatever It Takes’ Moment Powers European Markets” by Jan-Patrick Barnert, Sagarika Jaisinghani and Alice Atkins, via Bloomberg.

[2] Source: Bloomberg story (see Source 1), via Bloomberg.

[3] Source: Bloomberg story (see Source 1), via Bloomberg.

[4] Source: Bloomberg story (see Source 1), via Bloomberg.

[5] Source: Bloomberg data.

[6] Source: Bloomberg data.

[7] Source: Bloomberg data.

[8] Source: S&P Global data representing the S&P 500 via Bloomberg.

[9] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01175