Key Events: Mixed Jobs Data Implies ‘Perfect Miss’

Non-farm payrolls increased by 139k, which was better than the consensus estimate of 126k. That may sound like ‘beating’ expectations, but revisions to the previous 2 months were down by a cumulative 95k jobs [1]. The data amounted to a ‘perfect miss’ with revisions confirming a slowdown in growth with recent activity better than feared.

Manufacturing payrolls and the participation rate declined, but average hourly earnings were slightly better than expected and consumers continue to spend according to strong consumer credit data[2].

Market Review: S&P Claws Back to 6,000

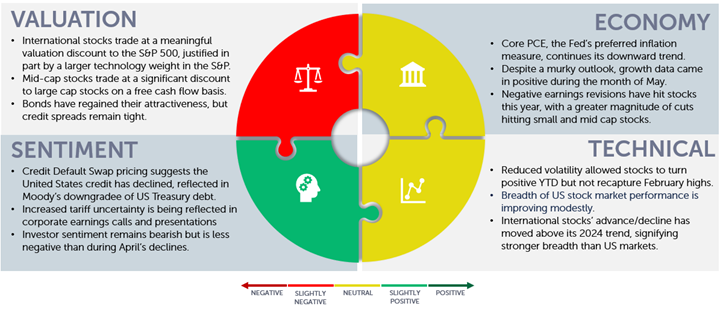

US equities responded vigorously to the employment data on Friday as it was much better than feared after decidedly weaker ADP data earlier in the week (not the first time we’ve seen that).

Outlook: Trump and Xi Expected to Meet Soon

The jobs data may have been the primary economic focus for the week, but the market’s desire to see progress on trade talks remains a critical element supporting investor confidence. News that Trump and Xi have agreed to meet was greeted positively as the hope for improving trade negotiations is a key factor supporting markets; the desire for rate cuts is another.

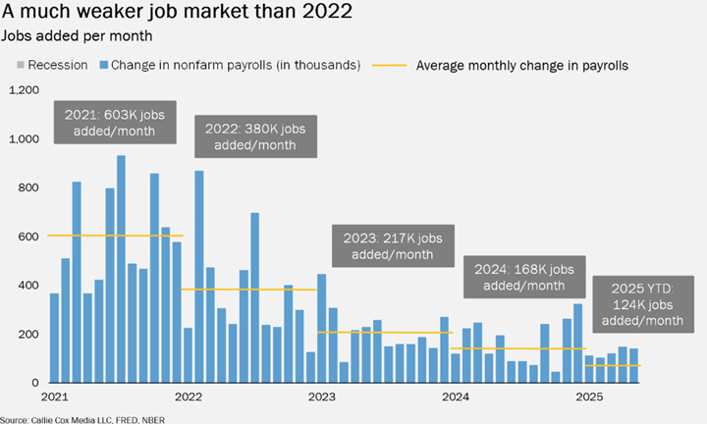

President Trump continued to voice displeasure with Fed Chair Powell over interest rates throughout last week. Signs of weakening employment, the cost of US debt and the fact that the ECB has cut rates materially have been the rationale for the President’s wrath with Powell. Once the impacts to supply chains and price stability due to changing policy initiatives are more readily understood by the Fed, the flexibility to lower interest rates to shore up a decelerating job market (as shown in the chart below) should be greatly enhanced.

The Fed Chair upholds a dual mandate to promote stable prices and maximum employment. Even though job growth has softened, the unemployment rate remains low at 4.2% and inflation data hasn’t softened enough yet for the Fed’s liking. President Trump may ultimately get his wish with nearly 2 rate cuts priced in for 2025, but the magnitude and timing may fall short of his aspirations.

Long-term Yields Rising across the Globe[3]

Navigator Outlook: June 2025

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg economic data.

[2] Source: Bloomberg economic data.

[3] Source: Ritholtz Asset Management post from Linked-In (Callie Cox Media, FRED and NBER).

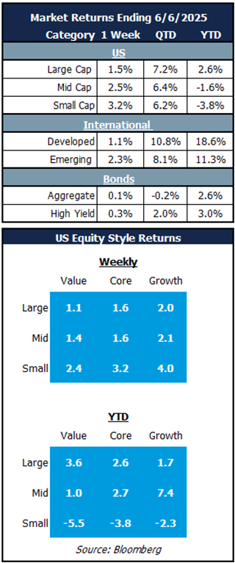

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01260