Key Events: The “Annie recession” gives us mixed signals

The recession we’re waiting for is either ‘always a day away,’ or may be a ‘rolling’ recession with one sector or region recovering while another declines:

-

-

-

-

-

-

-

- Data released this week showed a recovery in housing starts, but declines in bank deposits foreshadowed further weakness in the sector.

- While China’s manufacturing sector dipped back into contraction, broad emerging markets staged a recovery.[1]

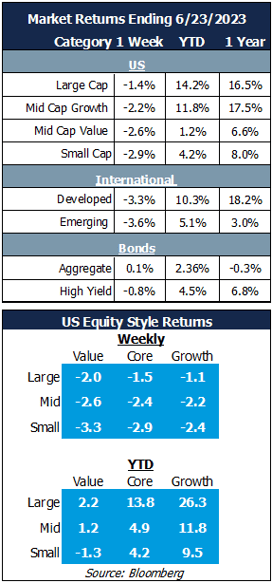

Market Review: The Fed says more rate hikes to come

This drove both stocks and high yield bonds down. The S&P 500 declined slightly while riskier sectors - small cap, international and emerging markets - fared worse.

Investment grade bond returns were flat as the market processed the Fed’s forecast of further rate hikes.

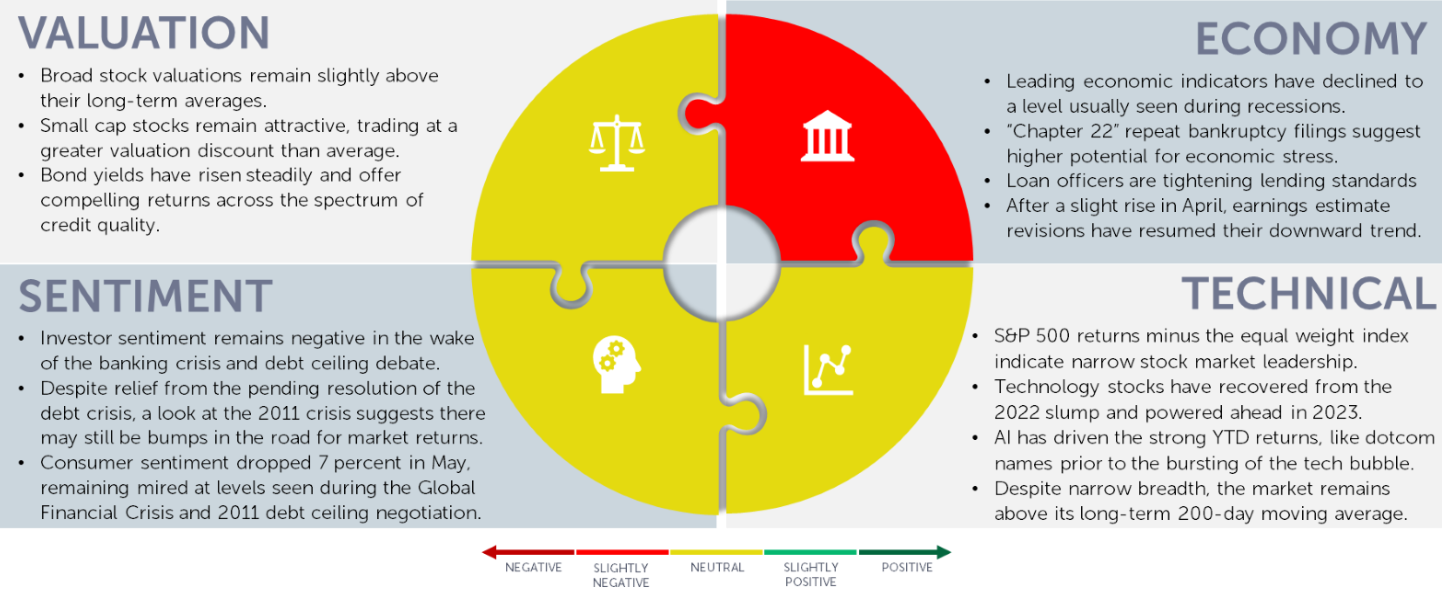

Outlook: Thinking about risk

Despite this week’s pullback, such strong 2023 returns may induce complacency; we, however, are thinking about risks in the markets and how to manage them.

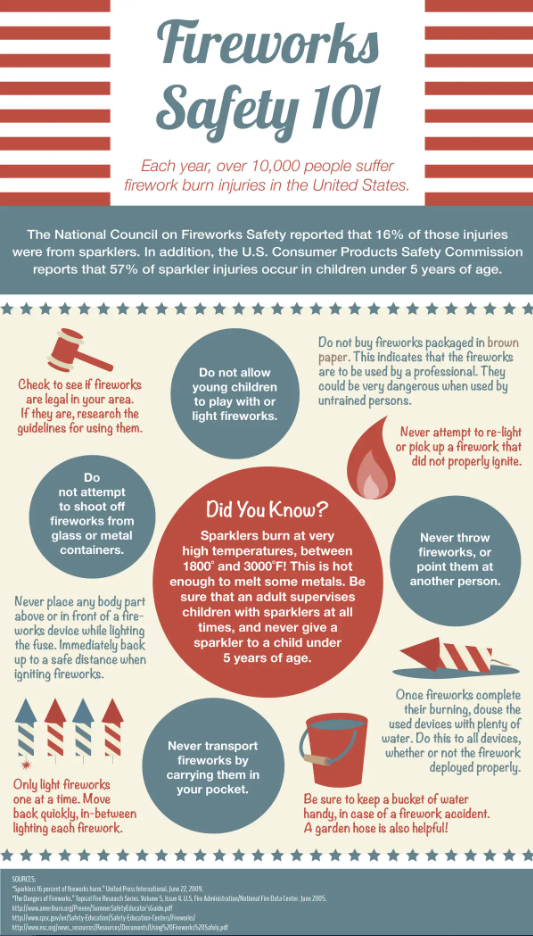

Risk management works best if it’s thought about before the risks come to fruition. Just as you should think about fireworks safety before lighting the match (see below), we think about managing risks when skies are blue.

Therefore, OneAscent portfolios remain broadly diversified, invested across the spectrum of sectors and regions that are in different phases of the economic cycle. We seek to preserve capital and make money in various economic environments, including recession or economic recovery.

Risk management for Independence Day[2]

Navigator Outlook: June 2023

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Bloomberg, S&P Global manufacturing purchasing managers index data

[2] Source: DWK_Fireworks_Final_HighRes.jpg (1200×2100) (wp.com)

[3] Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggretate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00313