Key Events: Monitoring global economic health

Weak European economic data prompted hopes for further Central Bank rate cuts; Canada was the first G7 nation to cut rates in June. The European Central Bank has cut rates once but also lifted their inflation forecast.

In the US tension remains between inflation that isn’t decelerating rapidly amidst signs of economic slowing.

Market Review: It’s AI’s world, we’re just living in it

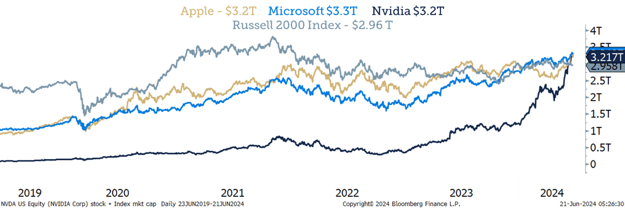

Nvidia, Apple, and Microsoft are dominating like Frank, Sammy, and Dean.[1]The stocks were up 15%, 9%, and 8%[2]last week, respectively, leaving other stocks in the dust.

Emerging markets kept up as Taiwan Semiconductor, who makes Nvidia chips, was up 16%, and India continued its strong performance.

Bonds, again, reacted to softening data, gaining enough to bring them almost back to positive for the year.

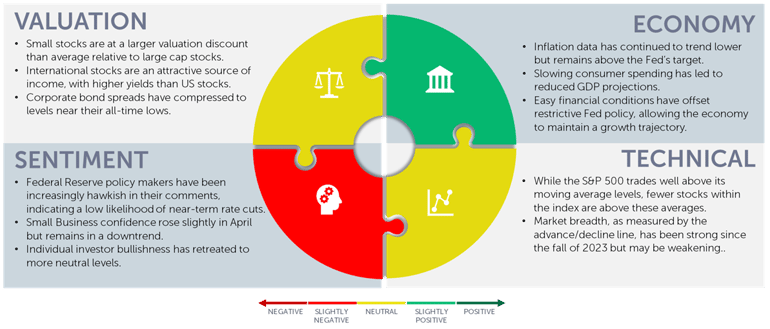

Outlook: Fighting complacency

After yet another week of tech dominance, it may be tempting to jump on the bandwagon; after all, the S&P 500 is up 15% for the year while tech is up 28% and semiconductors are up 79%! The average stock in the S&P 500 is up only 5.6%.

Tech stocks outperformed the S&P 500 by 14% last year, and by 24% so far this year. This is a far cry from the dotcom bubble: tech outperformed the market by 67% in 1998 and 68% in 1999. Valuations are not as extreme as they were in 1999.

But from the peak in March of 2000, technology stocks suffered an 80% loss and didn’t recover their drawdown until January of 2017. You read that right: Technology stocks spent over 16 years below their dotcom bubble peak.[3]

We’re not necessarily telling investors to be concerned about tech’s dominance – but now is the time to be vigilant. We encourage investors to manage risk through diversification. We believe there are plenty of opportunities in small cap and international stocks that are not nearly as expensive as US large cap stocks. As the below chart shows, Apple, Nvidia and Microsoft are all larger than the small cap stock market! Small caps might just be a decent place to find some attractive stocks.

Three companies are now worth more than the entire small cap stock market [4]

Navigator Outlook: June 2024

Download PDF Version

This material is intended to be educational in nature,[5] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Dean Martin is attributed as saying “It’s your world, Frank, we’re just living in it” in reference to Dean, Frank and Sammy Davis, Jr.

[2] Source: Bloomberg

[3] Source: Bloomberg

[4] Source: Bloomberg

[5] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00818