Key Events: Israeli strike escalates tensions

Driven by its determination to eliminate the existential threat of Iran’s nuclear ambitions, Israel launched an unprecedented assault that plunged the Middle East into escalating conflict.

The intensifying crisis overshadowed otherwise positive economic signals, including easing inflation, rising consumer sentiment, improved small business optimism, and progress in U.S.- China tariff negotiations.

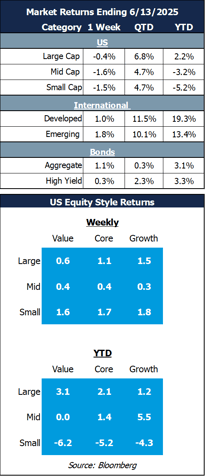

Market Review: War derails US stock recovery

U.S. equities declined on Friday, capping off a losing week, with energy emerging as the sole positive sector in the S&P 500 amid a sharp rise in oil prices. Meanwhile, international stocks maintained their recent momentum, and bonds posted gains as cooling inflation data boosted expectations for potential rate cuts this fall.

Outlook: Market perspective and recession risk

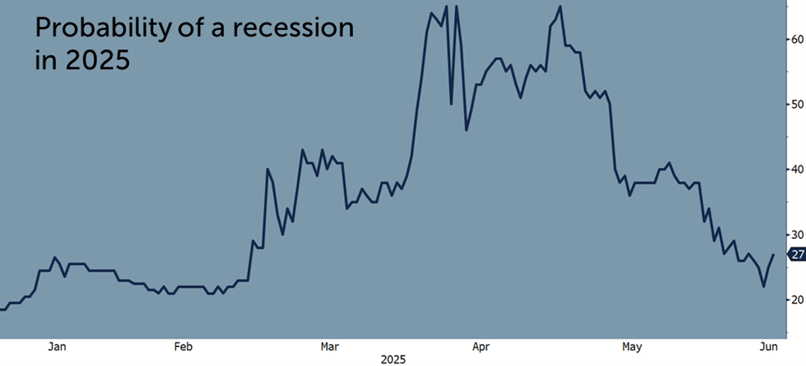

Following April’s “Liberation Day” tariff announcements, market perception of recession risk surged to 65%, but eased significantly to 22% by last Thursday. Israel’s strike on Iran caused only a modest uptick in probability, to 27% (see the second chart below).

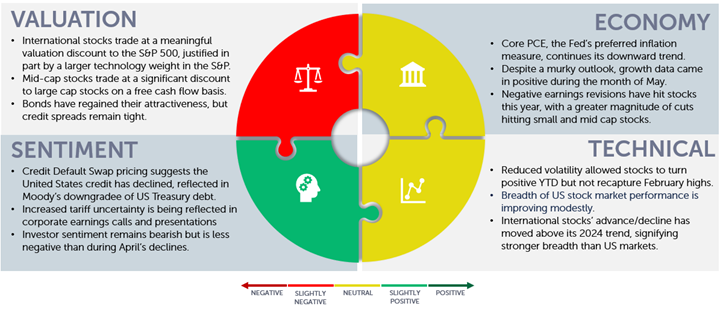

Encouragingly, this week brought positive inflation data, and FactSet reported a decline in CEO mentions of inflation—further evidence that the disinflationary trend remains intact.[1]

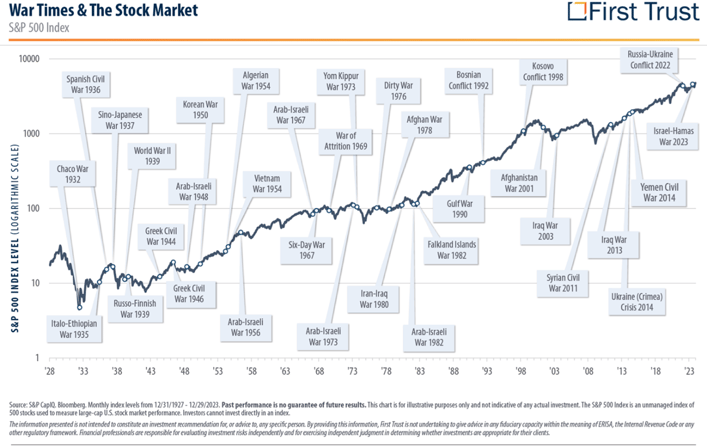

The key takeaway this week is the importance of maintaining a long-term investment perspective. As illustrated in the first chart below, while geopolitical conflict in the Middle East is deeply concerning, history shows that such events, though tragic, should not derail a disciplined portfolio strategy.

The two primary structural challenges facing markets—U.S. fiscal imbalances and elevated equity valuations—remained largely unchanged. As a result, our portfolio strategy remains steady, emphasizing diversification and a focus on high-quality, attractively valued assets.

While war in the middle east is unsettling, history teaches us to maintain a long-term perspective [2]

Recession risk increased slightly after Friday’s attack [3]

Navigator Outlook: June 2025

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: FactSet Are More S&P 500 Companies Citing “Inflation” on Earnings Calls for Q1?

[2] Source: First Trust

[3] Source: Bloomberg, Polymarket

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01261