Key Events: The year of the election

India and Mexico held elections this week, and dozens more countries, including ours, will follow suit before January 1st. Narendra Modi remains India’s Prime Minister, but with less support than expected. Claudia Sheinbaum became Mexico’s first female president; worry over her policies triggered Peso volatility and a selloff in the stock market.

The US finished the week with a strong employment report, further delaying Fed rate cuts. Meanwhile, the European Central Bank cut rates despite raising its inflation forecast.

Market Review: Tech and elections in the driver’s seat

More gains from the technology sector drove the S&P 500 higher as small and midcap US stocks lost money.

Continued gains in India drove emerging markets higher, and the bond market gained on slowing economic data.

Outlook: Earnings and rates trump elections

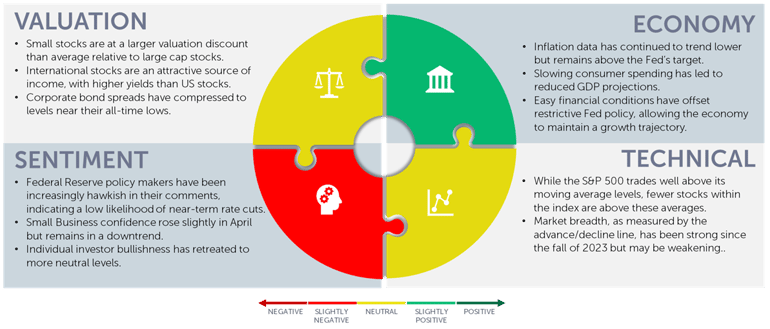

The US elections, while incredibly important, will not likely be the most important driver of markets in 2024, as earnings and interest rates carry more weight.[1] The market expects strong and broad earnings growth and is hoping for interest rates cuts. A miss on either may spell trouble.

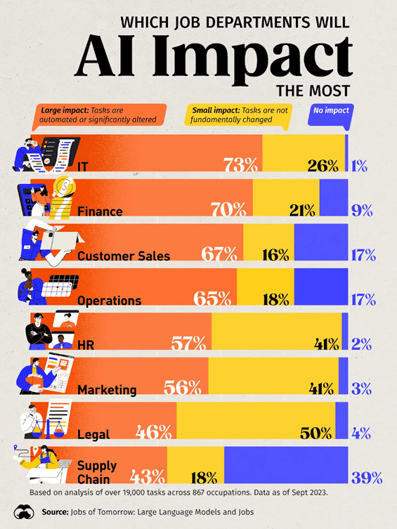

We acknowledge the strong growth tailwind of AI (see the chart below) as well as the significant Fiscal stimulus. We have never had deficits this large outside of a recession or a major crisis (such as the COVID pandemic).[2] These two forces have driven recent momentum in the stock market, momentum which may prove fleeting. We are poised to benefit from strong growth but remain focused on risk management in every asset class.

We are not worried about poor earnings, inflation, or a recession, but we are prepared for them.

The impact of AI on the job market [3]

Navigator Outlook: June 2024

Download PDF Version

This material is intended to be educational in nature,[4] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: See the earnings commentary in our monthly outlook https://investments.oneascent.com/blog/monthly-update-june-2024

[2] Source: Congressional Budget Office The Budget Outlook and Options for Reducing the Deficit | Congressional Budget Office

[3] Source: Visual Capitalist Chart: The Jobs Most Impacted by AI (visualcapitalist.com)

[4] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00810