Key Events: Political fireworks and shifting winds

Elections dominated the news cycle:

- Democrats wrestled over Biden’s candidacy amid daily calls for him to withdrawal.

- The left scored big gains in Britain whereas the right struggled to maintain initial gains in France.

Economic data in the US showed signs of softening.

Market Review: Thinking about a US slowdown

This week’s data showed economic softening which hurt small cap stocks. Large caps gained as the data supported the soft landing narrative.

International stocks continued their momentum from the second quarter, gaining as the dollar weakened.

Outlook: Shifting narratives

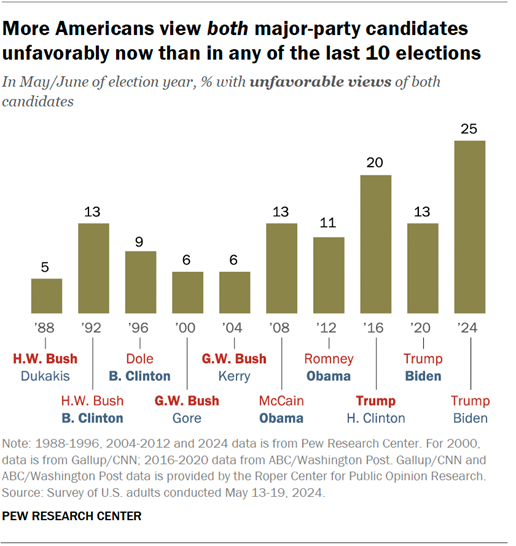

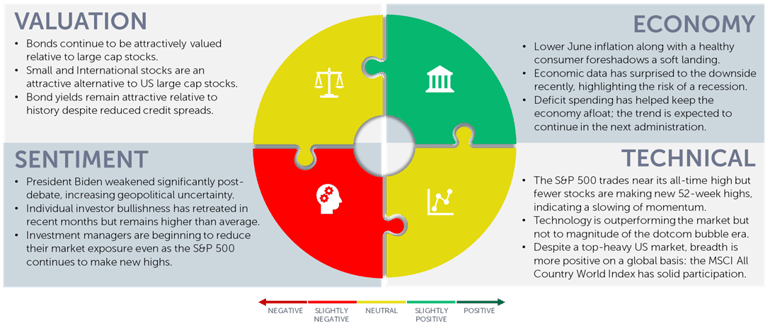

The current political landscape provides ample discussion points, from seismic changes in Europe to the turmoil in the US presidential election. The most critical development lies in the US; a change in the Democratic candidate could reshape the election, injecting uncertainty to the investment markets.

The economic narrative is also evolving. Recent data releases suggest a slowing economy in the coming months, raising the probability that the soft landing becomes a hard landing – that’s what usually happens, after all.

We remain cautious rather than reactionary. We have made prudent adjustments to the portfolios and are closely monitoring the upcoming earnings season. A broader base of earnings, beyond the technology sector, would be healthy, likely leading to a broadening of stock market returns.

Navigator Outlook: July 2024

Download PDF Version

This material is intended to be educational in nature,[1] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00818