Key Events: Olympiad of volatility

Political volatility continued as Kamala Harris claimed the nomination while the republican VP pick, JD Vance, was met with skepticism.

The market continued to digest a volatile rotation out of technology stocks based upon moderating inflation and expectations of a September rate cut.

Market Review: Rotation out of tech continues

The rotation away from technology continued as the sector lost over 2% and is down 9% since July 10, when the rotation began.

Large cap stocks are now flat on the month, while small caps are up 10%, echoing their strong 4q2023 performance - another period of increasing expectations for rate cuts. Bonds were flat despite expected September rate cuts as the initial 2Q GDP estimate surpassed expectations.

Outlook: Is the broadening of returns sustainable?

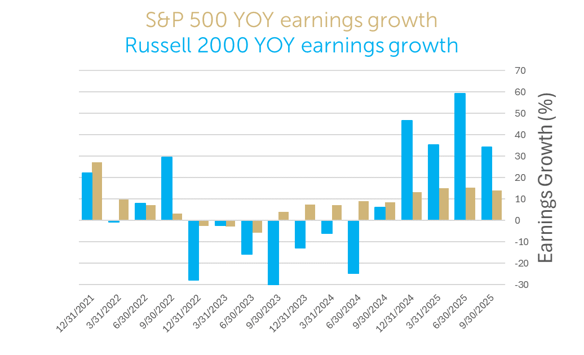

The violent rotation out of tech stocks has been technical - based on unwinding of bullish positions [1] as expectations for a September rate cut increased. There are, however, fundamental underpinnings to the shift. The Chart below shows that small cap earnings are expected to experience a much stronger recovery.

Small cap stocks are projected to begin positive earnings growth in the third quarter and surpass large company earnings growth soon thereafter. This supports an overweight position in small and mid-cap companies based on attractive valuations and fundamentals that are catching up to, and may surpass, those of large caps.

We advise investors to remain diversified while leaning into the areas with greater probability of success.

Earnings rotation[2]

Navigator Outlook: July 2024

Download PDF Version

This material is intended to be educational in nature,[3] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: National Association of Active Investment Managers Exposure Index reached an extreme level in early July NAAIM Exposure Index | NAAIM.

[2] Source: Bloomberg

[3] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00905