Key Events: Please reboot

A widespread technology outage caused significant disruption to airlines, banks and hospitals.

President Trump rebooted the Republican Party in his family’s image as he accepted the Republican nomination, while democrats seek to reboot their campaign by replacing President Biden.

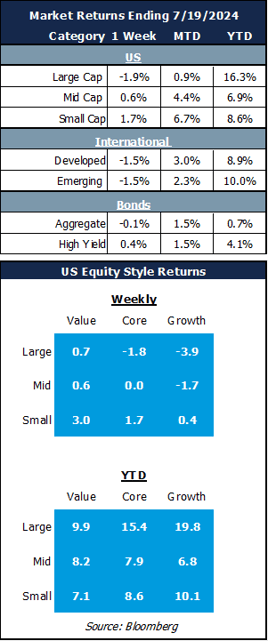

Market Review: Rotation from large to small

Small cap stocks continued their strong performance, up 1.7% for the week and 6.7% for the month, while large and international stocks declined 2% and 1.5% on the week, respectively.

Investment grade bonds took a pause from a July rally, while high yield bonds continued their strong performance in a sign of continued risk appetite.

Outlook: Broadening of earnings and returns

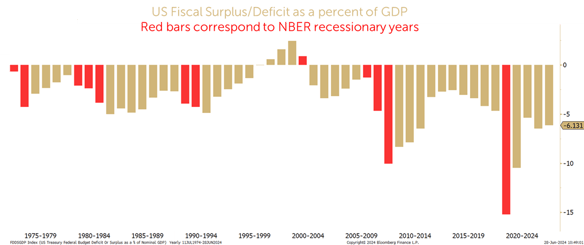

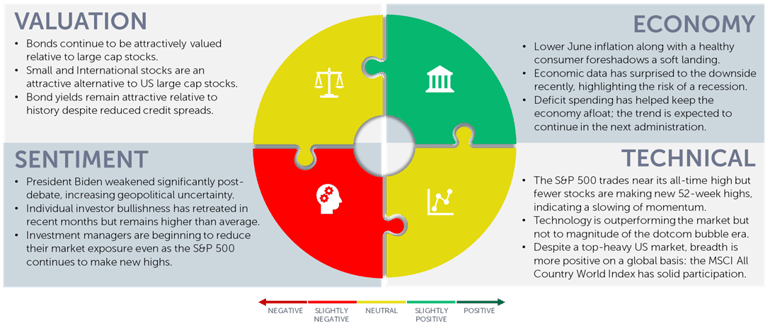

Lower inflation has driven a healthy shift towards small-cap stocks, as broad-based rallies tend to be more sustainable. Attractive valuations support this trend, as does governmental stimulus. Currently, we are operating with one of the largest fiscal deficits seen outside of a recession or wartime, supporting a potential soft-landing scenario which may allow the rally to continue.

There is a clear catalyst for the ongoing rotation towards small caps. After AI driven earnings drove large caps to dominance in 2023, forecasts indicate that small-cap earnings are poised to recover in 2024 and accelerate further in 2025.

As the 2Q earnings season kicks into gear, we remain cautious but fully invested, with an overweight position in fairly-valued small and mid-cap companies.

Budget Deficit Forecasts[1]

Navigator Outlook: July 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Congressional Budget Office.

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00842