Key Events: Assassination attempt

A failed attempt to assassinate President Trump increased electoral chaos, while President Biden failed to alleviate concerns about his cognitive abilities during a NATO press conference.

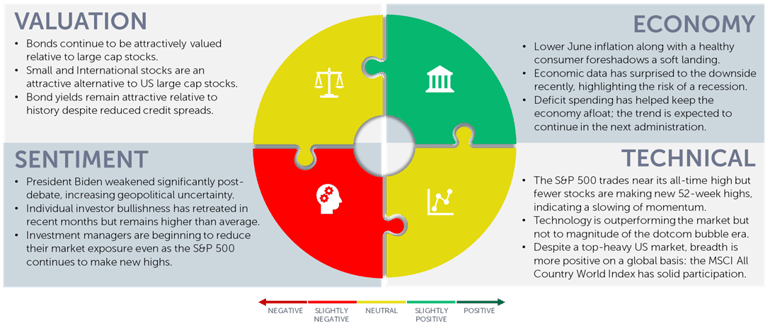

The dominant economic story was lower inflation, leading to market expectations of quicker rate cuts.

Market Review: Broadening market returns

Lower inflation data led to expectations of quicker rate reductions and slight bond market gains. This also sent small cap stocks up 6% for the week, while large caps ended slightly positive and international stocks continued their strong July.

Outlook: Lower rates vs a slowing economy

The economy has been slowing in recent weeks, as economic data has been worse than expected in manufacturing activity, the unemployment rate, consumer sentiment, and mortgage applications.[1]

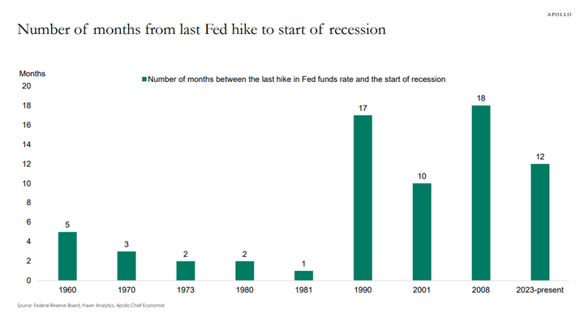

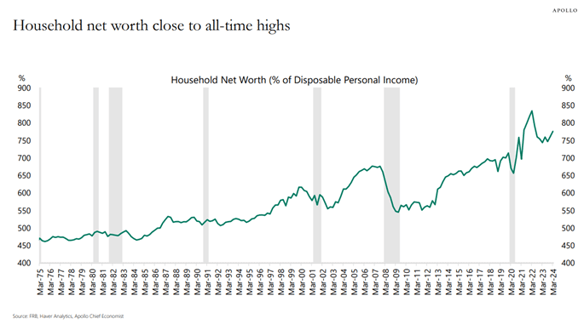

Stocks, however, are up significantly. This tension can be seen in the two charts below, both from Apollo. The first shows that the economy has gone longer than normal between the last Fed rate hike and the onset of a recession; the second chart shows that wealth has grown significantly relative to incomes. The wealth effect of rising markets has made the economy more stable.

Fiscal stimulus is another factor supporting the economy, as we are running one of the largest deficits ever outside of a recession or war.

We remain cautious but fully invested in our stock allocation. Lower inflation should allow the Fed to lower rates, deferring a recession and allowing market returns to broaden beyond the S&P 500.

Navigator Outlook: July 2024

Download PDF Version

This material is intended to be educational in nature,[2] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Institute for Supply management, Bureau of Labor Statistics, Conference board, Mortgage Bankers Association

[2] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00837