Key Events: A solid finish, an uncertain future

Key Events: A solid finish, an uncertain future

2.9% Fourth quarter ‘22 GDP growth beat estimates.

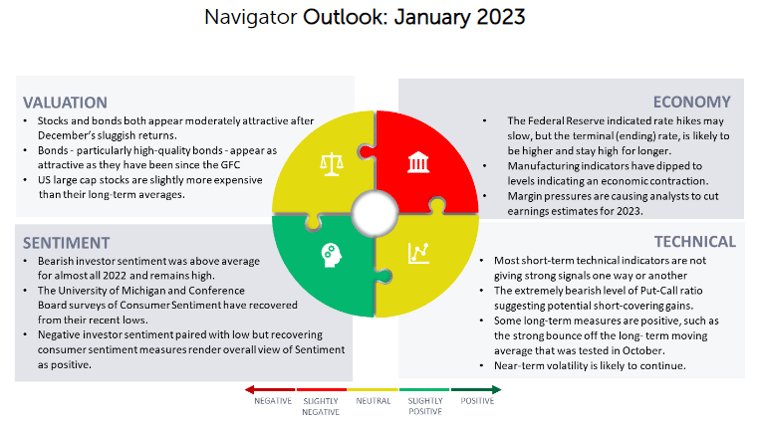

The future is murkier as a softening economy forewarns the recession that is now a Wall Street consensus expectation.

- Earnings slowdown: with 30% reporting, fewer companies are beating estimates than in any quarter since 3Q 2020. [1]

- The Fed’s preferred inflation measure is slowing. Core PCE rose 4.4% in December, still above the Fed’s 2% goal. [2]

Market Review: Mediocre earnings fail to derail the rally

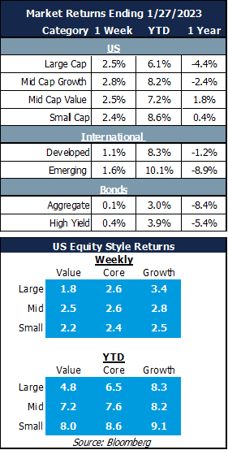

Markets returned to winning this week despite mediocre earnings and prevalence of layoff announcements. The S&P 500 gained 2.5%, bringing the YTD gain to 6.1%, but non-US markets lagged this week., Bonds finished slightly positive, adding to strong YTD returns.

Outlook: Egg-flation, but not the rest of the bird – or the rest of the economy.

We have seen stories about excessive egg price inflation caused by Avian flu. This strain of avian flu, however, does not affect broiler chickens, keeping “egg-flation” narrow. 🐣

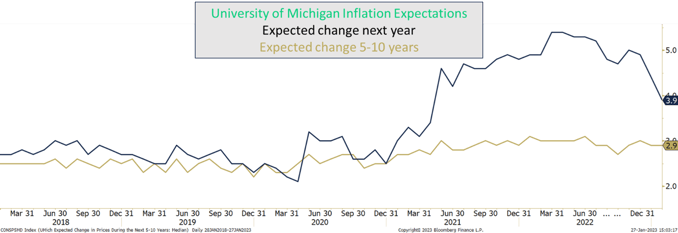

The narrower inflation is, the quicker it generally resolves. We see this dynamic in the current inflation data. As shown in the chart below,[3]long-term inflation expectations remain steady while short-term expectations (which tend to create a self-fulfilling prophecy) are decreasing sharply. Softer economic and inflation data may cause the Fed to soften their rhetoric.

Download PDF Version

[1] Source: Factset

[2] Source: Bureau of Economic Analysis

[3] Source: University of Michigan

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00167