Key Events: In with the new

The Trump administration commenced in force as executive orders fulfilled campaign promises, vigorously asserting his administration’s intent.[1]

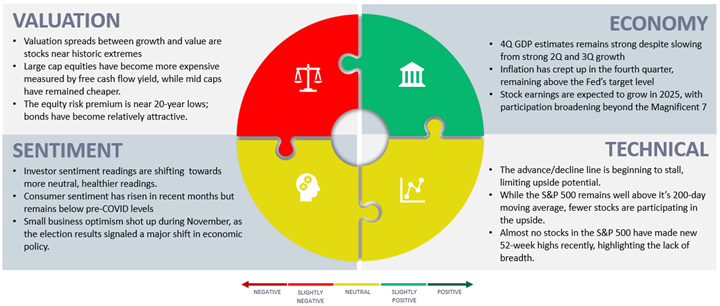

Economists increased GDP growth expectations for 2025 to 2.8%, a .5% increase over the last six months; inflation expectations rose as well.[2]

Market Review: GDP growth sends stocks higher

Large cap stocks, both US and non-US, led markets higher, while other risk assets rose more modestly. January returns are quite strong; see the returns chart below for historical context.

Investment grade bonds were flat in the absence of significant data releases.

Outlook: As January goes...

Returns have been strong through the first four weeks of January. A look at the chart below illustrates the maxim “as January goes, so goes the year”.[3]If the last week continues this strength we will find ourselves in a position which, historically, has led to strong gains for the rest of the year.

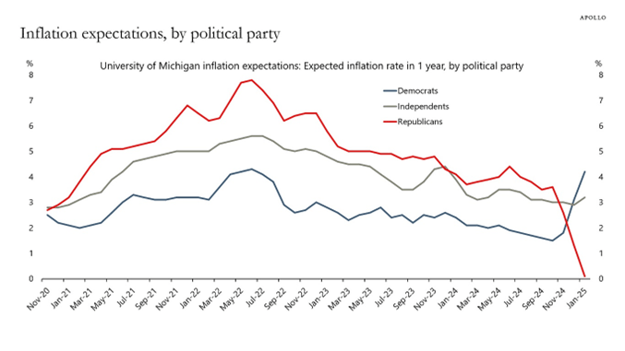

On risk is a resurgence of inflation. The second chart below shows that your views on inflation depend on your political views and those views have intensified since the election.

We suggest you keep your politics out of your portfolio. Despite the disinflationary trend, tariffs, border restrictions and current fiscal policies raise inflation risks.

We have prepared our portfolios for a wide variety of outcomes, including an increase in inflation. We advise clients to remain broadly diversified in a portfolio which accounts for opportunity and risk.

How you feel depends on your politics[4]

Navigator Outlook: January 2025

Download PDF Version

This material is intended to be educational in nature,[5] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: What executive orders has Trump signed so far? Week 1 full list – NBC Chicago

[2] Source: Bloomberg Economic Survey

[3] Source: NASDAW As Goes January...So Goes The Year? | Nasdaq, OneAscent Investment Solutions. Full-year returns have been significantly higher in years which experienced a strong January.

[4] Source: Apollo Inflation Expectations by Political Party - Apollo Academy

[5] Source: Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggregate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI01092